The State of the Photography Industry – 2022

April 20th, 2022

Following a survey of more than 3,300 global photographers this past March, trends clearly show that the industry is emerging from the fog of COVID as many aspects of society and business return to normal. Since the first State of the Photography Industry Survey conducted in February 2021 and repeated in May 2021, Zenfolio and Format continue to track the impact of the pandemic, the business adjustments made, industry trends, and future outlook of photographers. Let’s drill down and see what the data reveals…

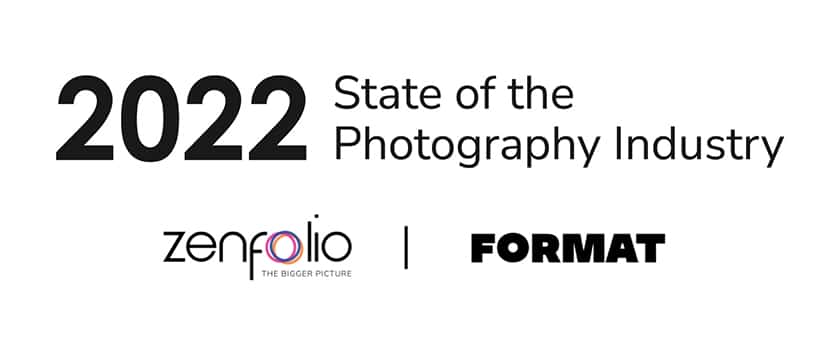

Photographers We Surveyed

The March 2022 survey reflects feedback from 3,398 photographers in 97 countries around the world. 71% of responses were from the US, UK, Canada and Australia, with the US accounting for over half. Among the smallest and most remote countries represented were Trinidad & Tobago, Equatorial Guinea, and Lesotho.

Full and part-time self-employed photographers also accounted for 71% of respondents, with photography hobbyists, students and employees making up the balance. The data reflects the views of a seasoned group, as over half of survey participants reported having more than 10 years experience.

Optimism…with a Caution Light

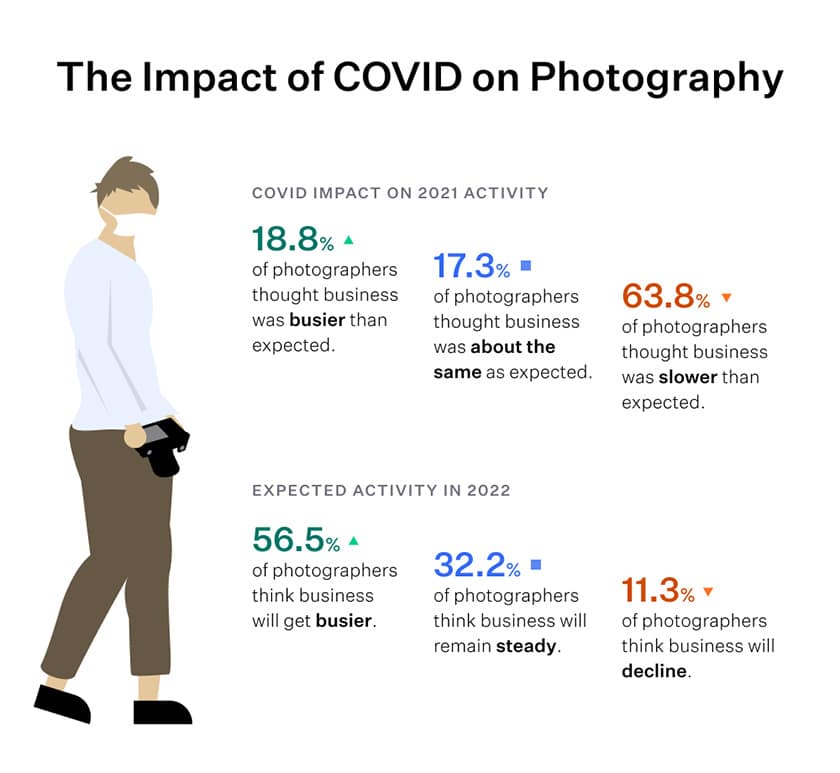

On the heels of a “slower-than-expected” 2021, the survey participants are cautiously optimistic about the current year business climate. Even though a robust 89% reflect an overall optimistic attitude about business this year, a closer look reveals a spectrum of sentiments.

In the survey from May of 2021, 49% said they expected their photography business to get stronger in the upcoming months, up from only 37% in the previous February survey. However, in the newest survey 64% reported that business ended up as disappointingly slower than expected, due primarily to COVID impact.

Photographers and Business Growth in 2022

The most recent survey reveals that 57% feel good about the rest of 2022 as they expect activity to get busier, while 32% think it will remain steady, and only 11% expect a decline from their current level of activity. Let’s look more into COVID repercussions later.

Download the free, full report to view the breakdown of this data by photography specialty, location, employment status, and client type.

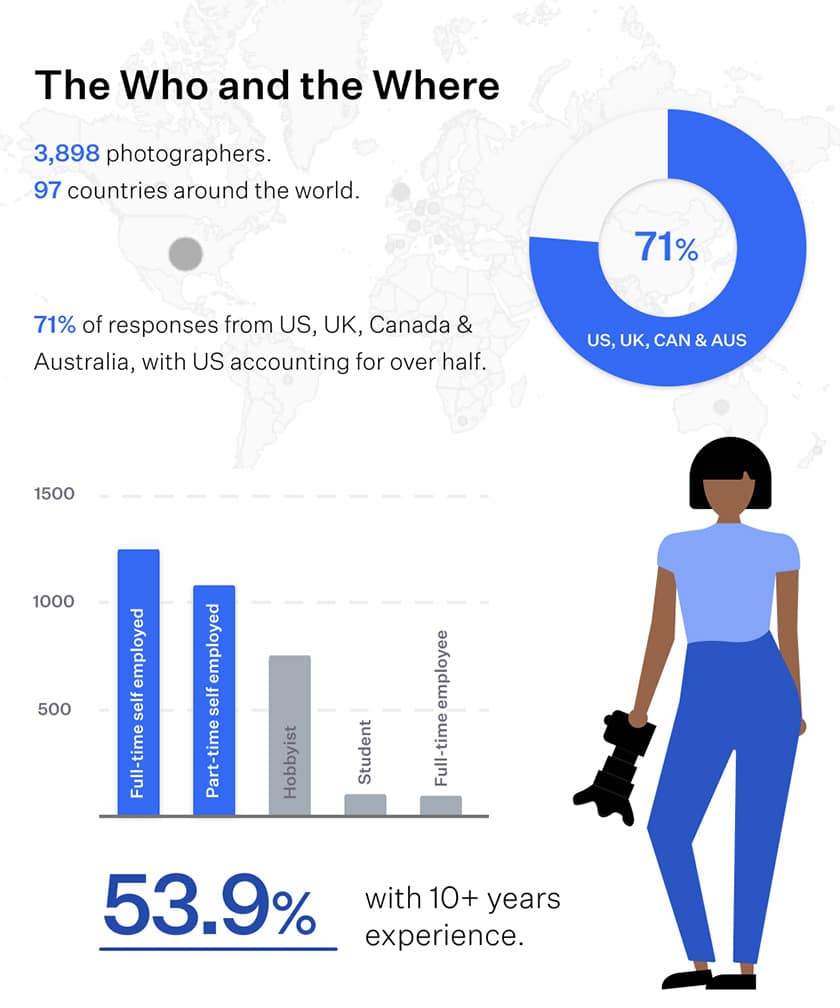

About the Business of the Business

The primary photography specializations indicated in the March 2022 survey were highly diversified across 15 genres reported. While the leading genre might be expected, the second and third largest categories were surprisingly positioned:

Top 3 Photographer Specializations for 2022

- Portraits – 19.3%

- Landscape – 11.4%

- Wedding – 8.7%

Fine Art followed at 7.6% and then a tightly bunched group were Events, Sports, Documentary and Commercial, all coming in at 6.3-6.5% each. Fashion/Beauty, Wildlife, Family and Travel came in with progressively smaller slivers of the pie.

Over 83% of photographers disclosed that they work with 3 or fewer types of clients, with 37% saying that they work with just one type. The vast majority of clients are categorized as individuals or small/medium businesses, while enterprise, institutions, publications and agencies comprise the rest.

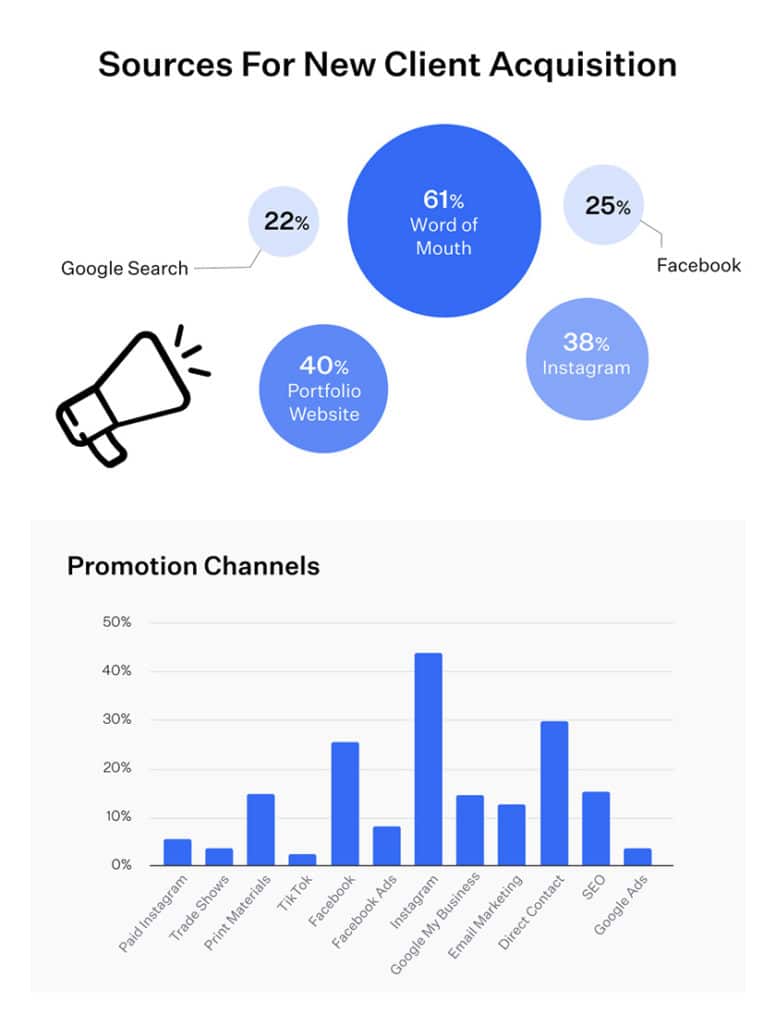

How Photographers Find Clients

When it comes to finding clients, traditional word-of-mouth marketing is still the top method, while portfolio websites are the most important online tool for client acquisition. Instagram is the preferred social media channel for showing off work to reach a larger audience.

In the full report we look at how many specialties photographers focus on and how it impacts their revenue, along with which types of promotion are most used by photographers by specialty.

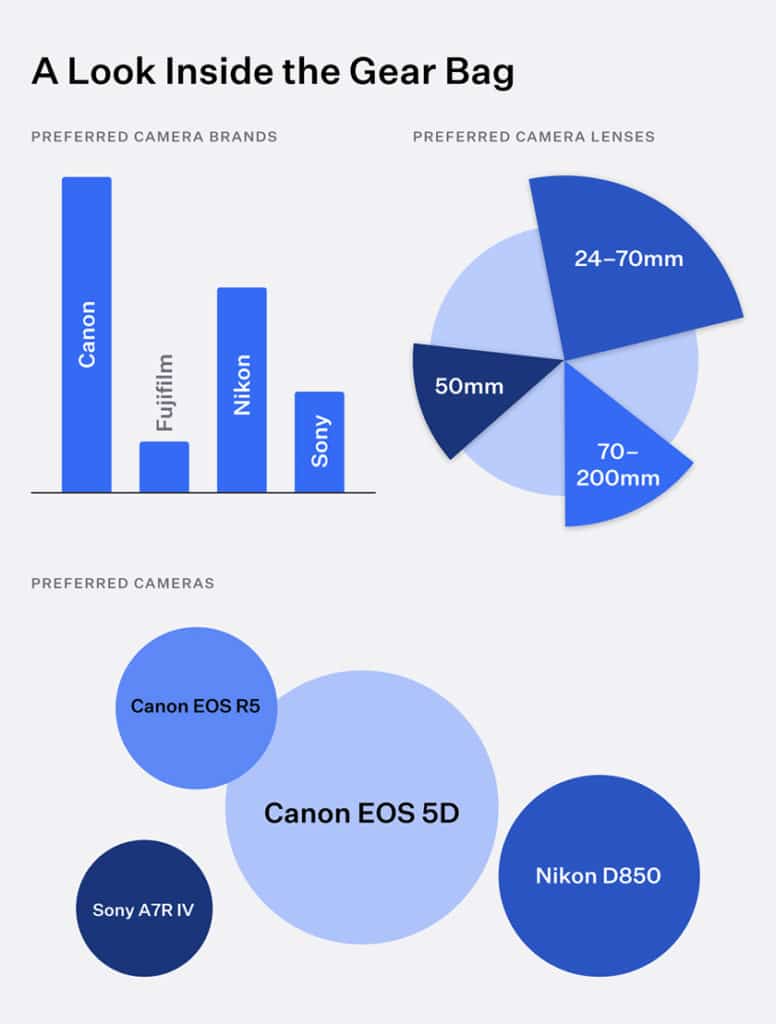

A Look Inside the Gear Bag

The decades-long Canon vs Nikon rivalry was also illustrated in the survey results. As both brands evolved from film to digital to mirrorless technology, photographers of every level, from beginner to pro, gravitate primarily to these top two brands, and Q1 2022 was no exception.

When it comes to the preferred camera brands used by photographers, Canon and Nikon dominate with over 70% of the market, followed by Sony and Fujifilm with 15% and 7% respectively. The Canon EOS 5D Mark IV, Nikon D850, and Canon EOS R5 are the top 3 camera models used by photographers surveyed.

- Canon

- Nikon

- Sony

- Fujifilm

With zoom lenses coming in over prime lenses, the top 3 preferred lens focal lengths paired with camera bodies were:

- 24-70mm

- 70-200mm

- 50mm

In the full report, discover which cameras and lenses are preferred by photography speciality and see what other photographers in your specialty are shooting with.

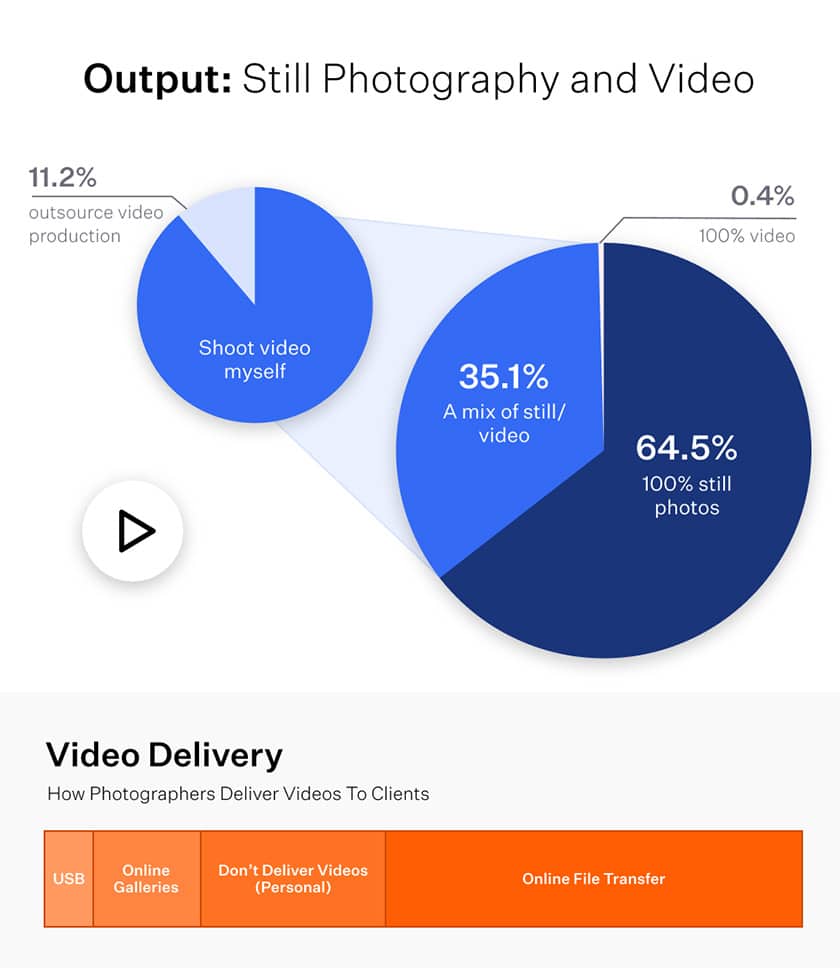

Even though most digital cameras can shoot both still images and video, the survey reflected that still photography is by far the primary medium for most of the survey participants with 64% shooting stills and 35% shooting a mix of still and video. Merely 11% divulged outsourcing video production to someone else. Online file transfer accounts for half of the logistics for video delivery.

The Impact of COVID on Photography

The pandemic-driven business rollercoaster of 2021 has given way to a more consistent and optimistic outlook for ’22 as revealed above. Now, let’s look at who was most/least affected and how they kept their business afloat.

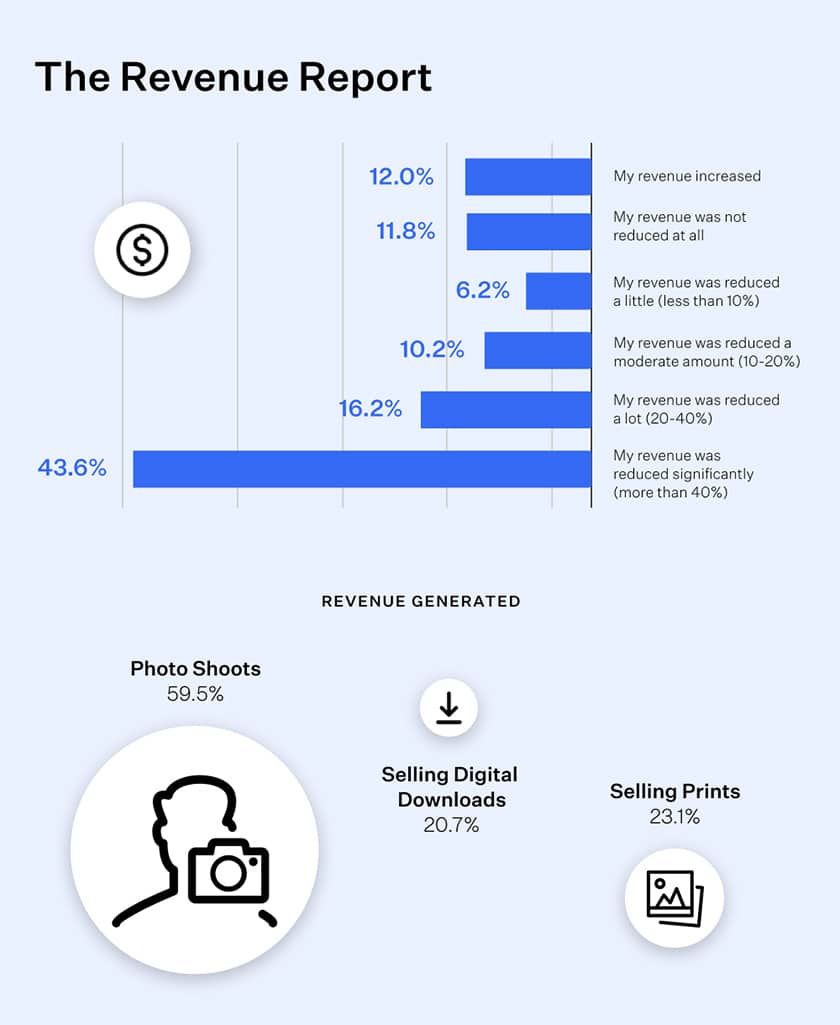

Respondents who identified as part-time self-employed were the most negatively impacted during COVID, as nearly half reported losing more than 40% of normal revenue during 2021. Full-time self-employed were similarly affected as 43% lost over 40% of revenue. Full-time employees were the most insulated from COVID with the largest proportion indicating no impact or even improvement.

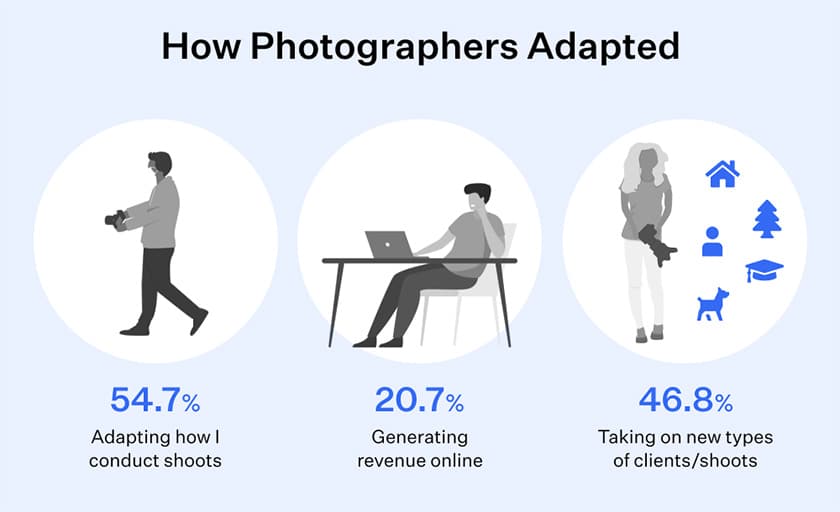

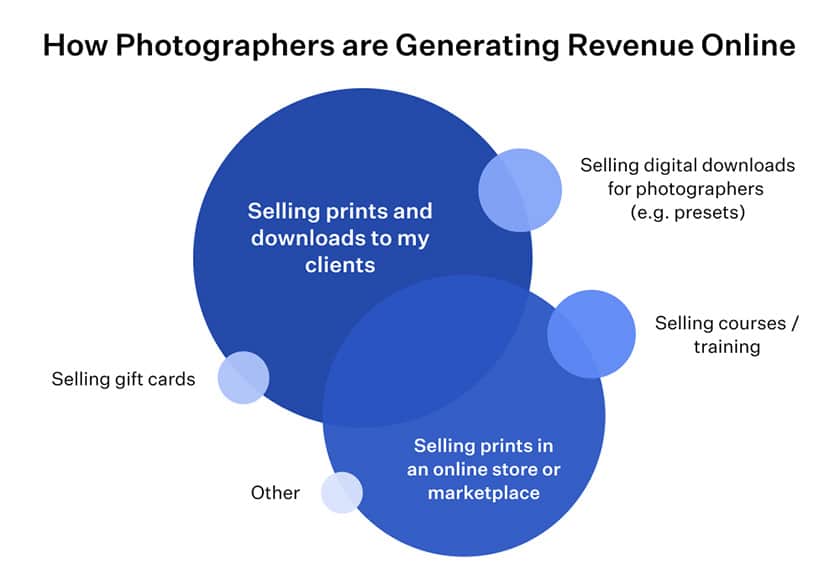

Nearly 55% of the pandemic-affected respondents said they adapted how they conducted photo shoots, such as physical distancing. And 20% focused on generating revenue online, mostly from selling prints and downloads directly to clients or through online stores and marketplaces. Some also brought in revenue from selling photography courses and training.

The Revenue Report

As reflected in the COVID Impact on 2021 Activity chart above, even though a majority of photographers said business was slower than expected, 23% of full-time and 14% of part-time photographers were actually busier than expected. What activities generated revenue for photographers during the year?

Close to 60% of respondents generated revenue from photo shoots or session fees. Respondents also generated revenue from selling prints and digital downloads online. What might not be expected is that online sales of prints and digital downloads beat out in-person sales. This is likely due to COVID restrictions and the growing acceptance of online sales in general.

Download the free comprehensive PDF to see how photographers within a certain specialty rank their revenue sources.

The Natural Immunity of Photographers

Similar to the experiences of most businesses over the past two yearsJust as most businesses experienced over the past two years, the photography industry was not immune to adverse repercussions and operational challenges. However, when considering “fight or flight” responses, photographers as whole showed resilience by adapting and sticking with the craft and commerce they love.

The May 2021 survey reported that only 10% exited photography as a full-time profession…at the height of pandemic restrictions. Now that typical events benefiting from photography are filling up family, school, and business calendars with reunions, celebrations, conferences, school & sports activities – hopefully photographers will benefit from a robust rebound in 2022. Zenfolio and Format will be monitoring photography industry trends, asking questions, and revealing the results in the next survey. Stay tuned.