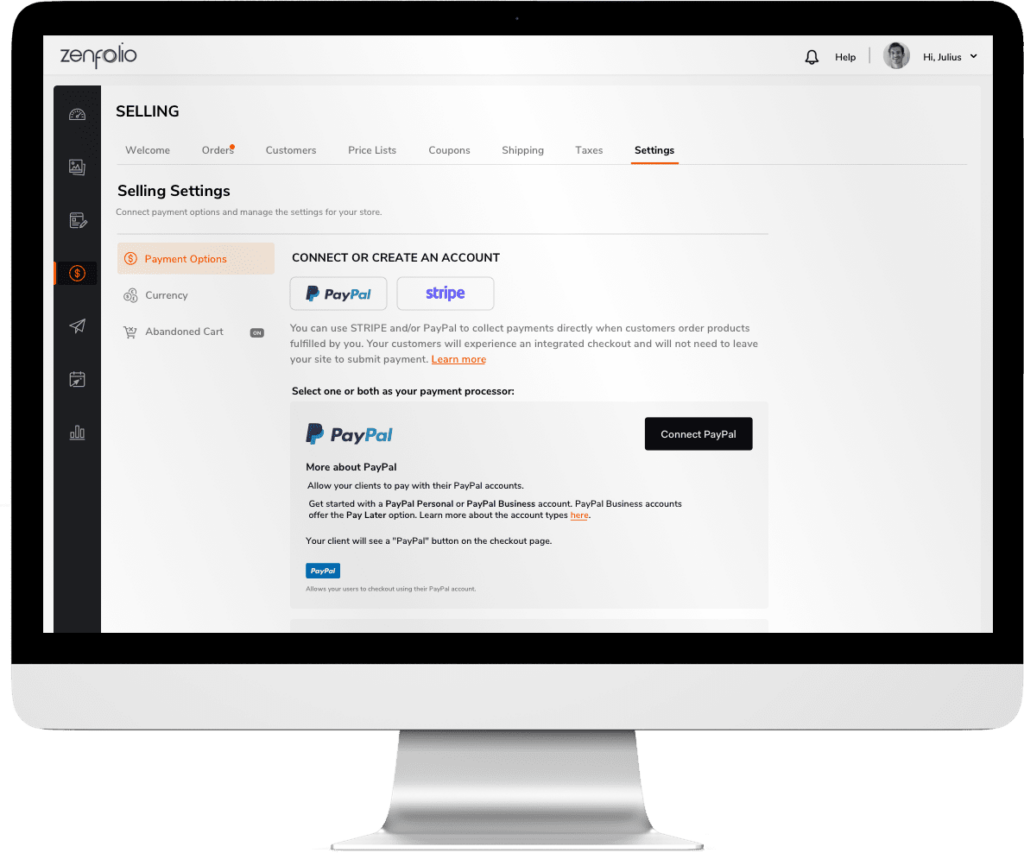

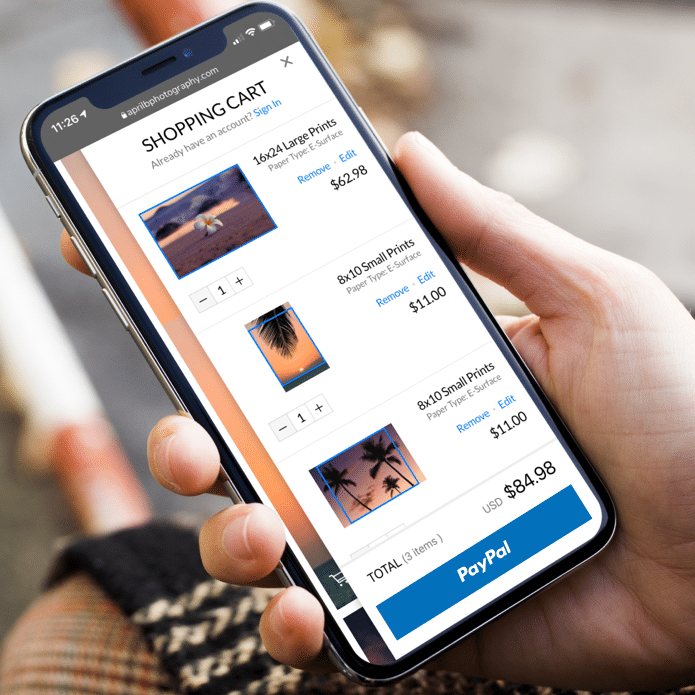

Drive conversion with PayPal.

PayPal’s brand recognition helps give customers the confidence to buy. PayPal complements what you already have, comes with PayPal, Pay Later, and more, and it’s easy to add to your new or existing checkout solution.

30% higher checkout conversion.2

More reasons to PayPal.

69%

of PayPal customers feel more secure shopping at a merchant that accepts PayPal.7

3x

purchase completion when PayPal is available at checkout.8

30%

more repeat buyers.9

Designed with your business in mind.

Payment methods.

Flexible features.

Peace of mind.

PayPal is preferred, trusted, and familiar to customers. 14

20 +

years of experience

200 +

markets around the globe

100 +

different currencies

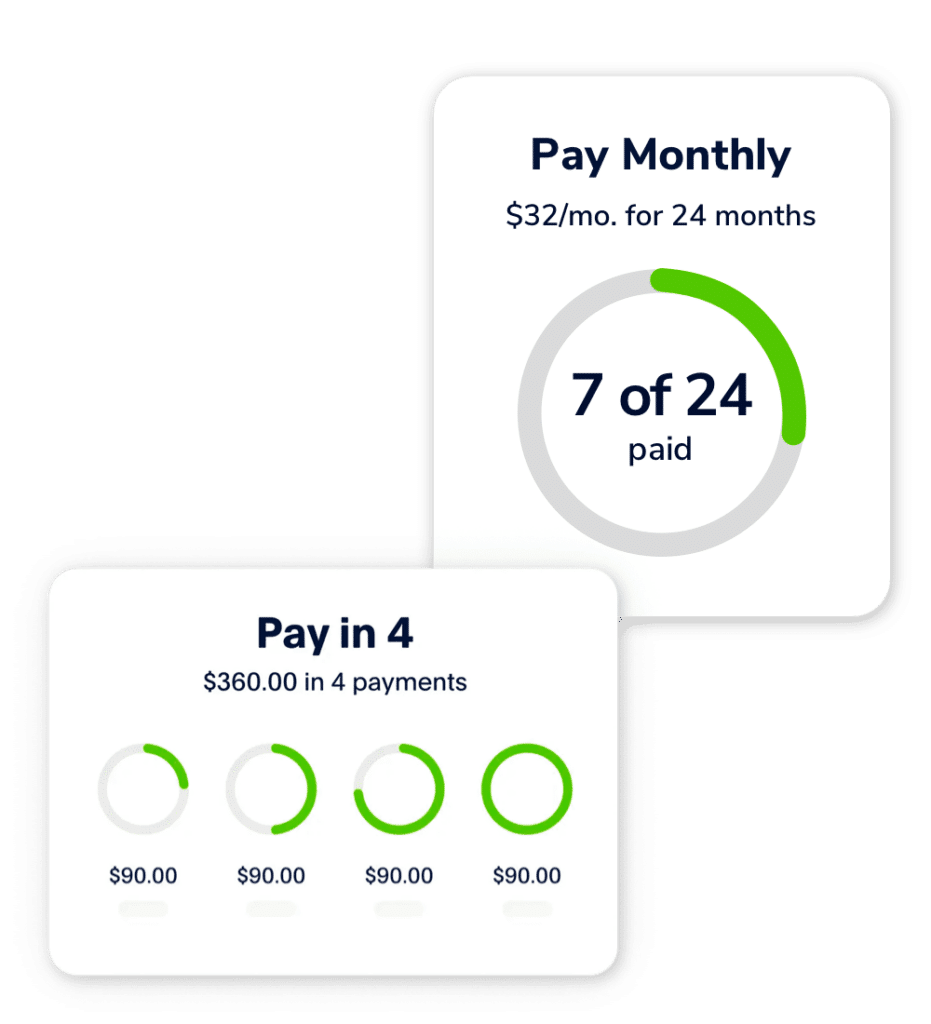

Simple setup.

Pricing with no surprises.

No monthly or setup fees. Only pay when you get paid.15

Learn more about fees in your country (region).

Fees vary by country and are subject to change.

- An online study commissioned by PayPal and conducted by Netfluential in November 2020, involving 1,000 US online shoppers ages 18-39 (among PayPal users, n=682).

- Nielsen Attitudinal Survey of 2,801 consumers who had made a recent (past 2 weeks) purchase across any of 8 verticals (e.g. health & beauty, fashion, groceries) in June 2020.

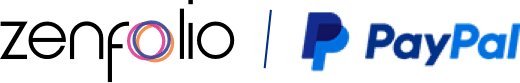

- About Pay in 4: Loans to CA residents are made or arranged pursuant to a CA Financing Law License. PayPal, Inc. is a GA Installment Lender Licensee, NMLS #910457. RI Small Loan Lender Licensee.

Pay Monthly is subject to consumer credit approval. 9.99 – 29.99% APR based on the customer’s creditworthiness. The lender for Pay Monthly is WebBank. PayPal, Inc. (NMLS #910457): CT Small Loan Licensee. RI Loan Broker Licensee. VT Loan Solicitation Licensee. - PayPal’s Buy Now, Pay Later is boosting merchant’s conversion rates and increasing cart sizes by 39%. PayPal Q2 Earnings-2021.

- 80% of BNPL users agree that seeing a BNPL message while browsing gives them the ability to spend more. An online study commissioned by PayPal and conducted by Netfluential in

November 2020, involving 1,000 US online shoppers ages 18-39. (Among BNPL Users, n= 357) - 74% of BNPL users are more likely to shop at a merchant again if they offer a buy now, pay later option. TRC online survey commissioned by PayPal in April 2021 involving 1000 US consumers

ages 18+ (among BNPL users, n=282). - An online study commissioned by PayPal and conducted by Netfluential in November 2020, involving 1,000 US online shoppers ages 18-39. (Among PayPal users, n=682)

- Nielsen, Commissioned by PayPal, July 2020 to September 2020 of 15,144 US consumers to understand and measure the impact that PayPal has for US-based LE merchants across different verticals.

- Nielson, Commissioned by PayPal, Nielsen Media Behavioural Panel of USA with SMB desktop purchases from 7,317 consumers who are PayPal users from April 2020 to March 2021.

- Availability may vary depending on merchant’s integration method and geographic location.

- Chargebacks that are not related to fraud or item not received (INR), such as broken item, significantly not as described (SNAD), refund not processed, and duplicate charge, are not protected by Chargeback Protection. Chargeback Protection is available for accounts enrolled in Advanced Credit and Debit Card Payments.

- Available for eligible transactions. Limits apply.

- Available on eligible purchases.

- Morning Consult – The 15 Most Trusted Brands Globally. March 2021. Morning Consult surveyed over 330,000 consumers across 10 international markets to provide a global view on the current

state of consumer trust across brands. - Our standard rate pricing listed herein is for US transactions only in USD and is effective starting on August 2, 2021.