2024 State of the Photography Industry Report: Exploring Products, Revenue, and the AI Revolution

Intro

As we ease into 2024, it’s clear that the photography scene, much like other industries, is rolling with the punches of post-pandemic life. In our latest survey—our 5th since 2021—conducted by Zenfolio Inc., we’re digging deep into what’s happening in the photography world. We’re talking about what photographers are specializing in, how their businesses are faring, and what they think about the rise of artificial intelligence in their field. Let’s take a peek into how photographers are adapting and thriving in this ever-changing landscape.

Thanks to the collaboration of six brands (Zenfolio, Format, ShootProof, SLR Lounge, Professional Photographers of America (PPA), and Miller’s Professional Imaging) in distributing the survey, the 2024 survey experienced remarkable growth, witnessing a 237% increase in total responses compared to 2023.

The 2024 survey garnered responses predominantly from North America, with 78% of respondents from the United States (73%) and Canada (4.8%), followed by the United Kingdom at 7.9% and Australia at 2.68%. Notably, California, Texas, New York, and Florida collectively constituted just over a quarter (28%) of the North American respondents. In total, the survey accumulated responses from 7,646 individuals across 102 countries.

Of particular interest is the inclusion of new countries this year, such as the United Arab Emirates, Malta, Ukraine, Iceland, and 20 others, signaling an expanding global participation in the survey.

What do you call yourself?

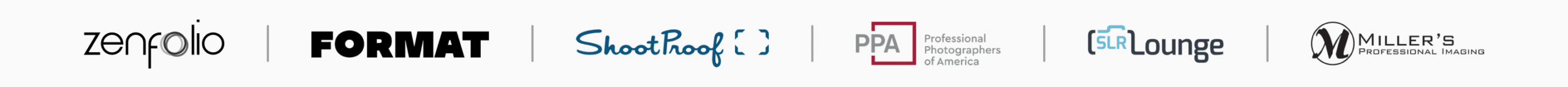

The data suggests a possible trend towards video content creation, as 66.5% of respondents identified solely as photographers (without video), a decrease from 69% in 2023. Conversely, the percentage of respondents who identified as both photographers and videographers increased by 4%, rising from 17.4% in 2023 to 21.1% in 2024.

Participants in the study revealed some positive news on the job front. In 2024, this survey found that more people are working for themselves full-time (47.9%, up from 41% in 2023), indicating a rise in entrepreneurship. On the other hand, fewer respondents are doing part-time self-employed gigs (42.2% in 2024, down from 47.3% in 2023), suggesting a shift towards more stable jobs. It seems like respondents are adapting to the changing economy by taking charge of their careers, with more choosing to go all-in on their businesses.

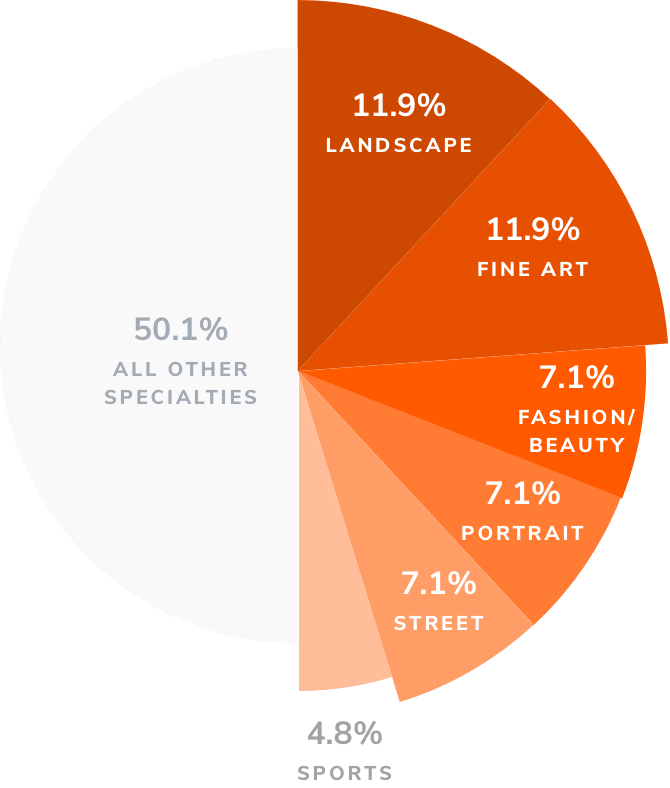

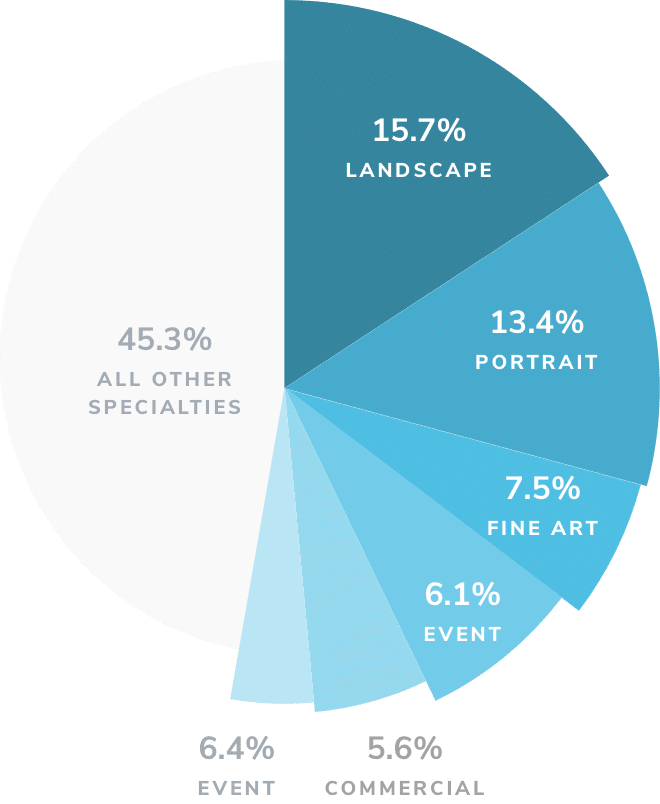

Specialties of Full & Part Time, Self-Employed Photographers

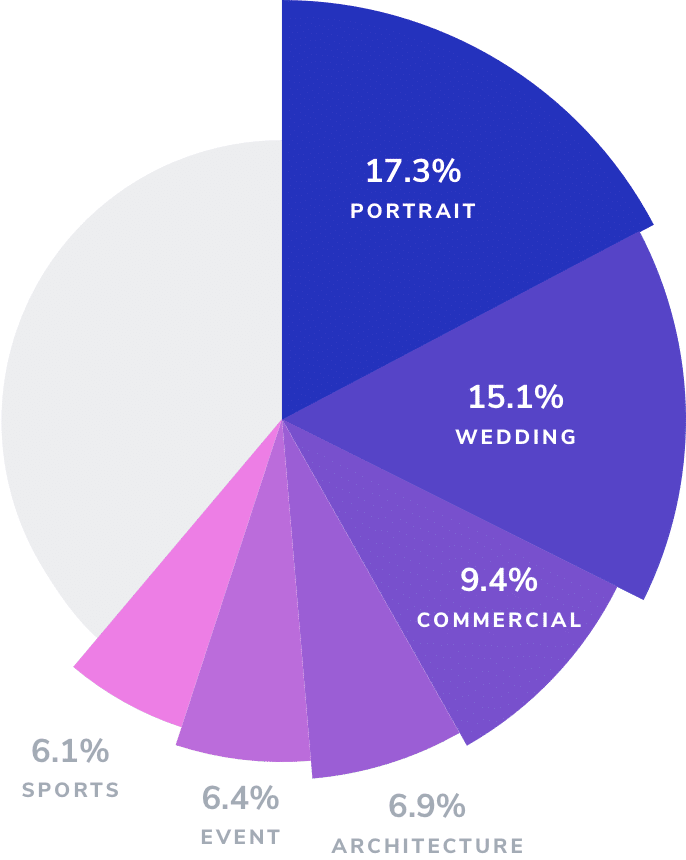

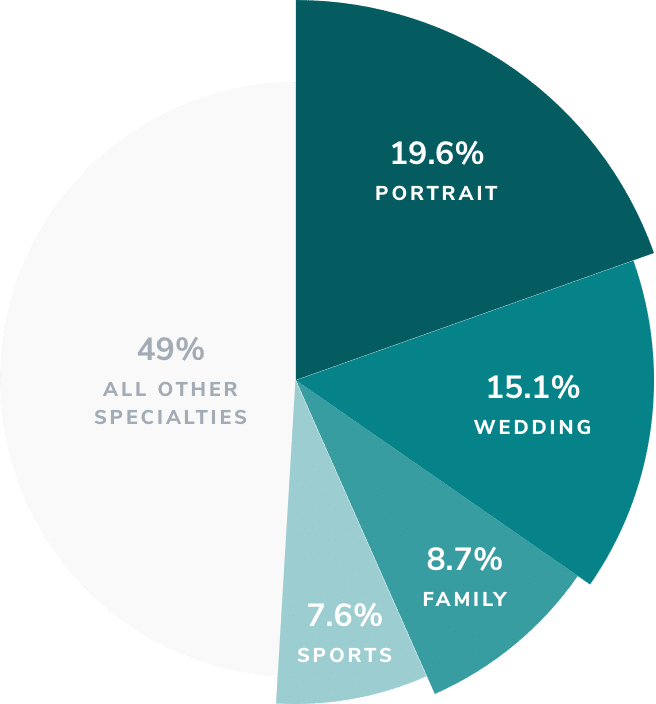

Photographers are adept at adapting to changing demands by refining their primary specialties. Specifically, among full-time, self-employed photographers who participated in the survey, the trends in 2024 show a shift away from Architecture as one of the top six specialties.

2024 Full-Time Self-Employed Specialties

2023 Full-Time Self-Employed Specialties

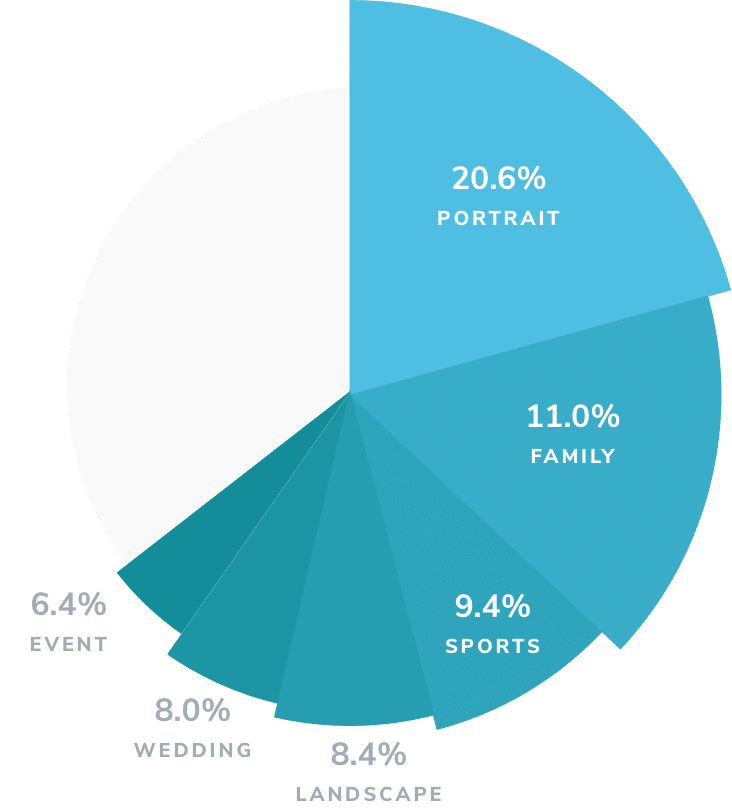

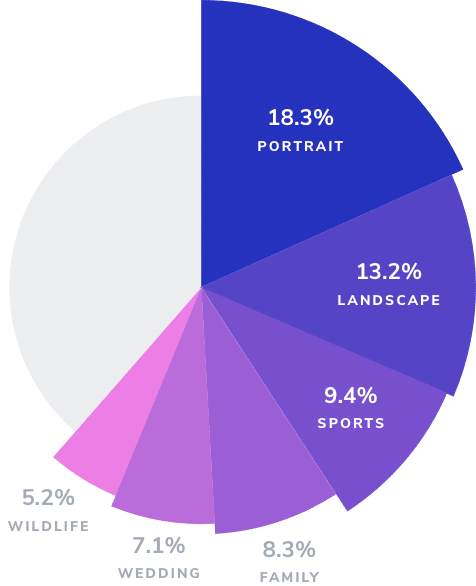

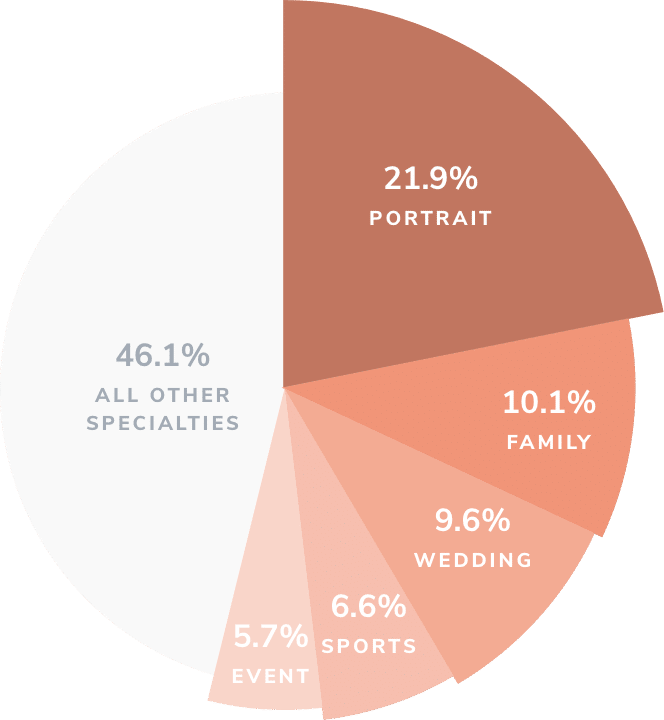

In contrast to the relatively minor changes observed among full-time self-employed photographers in the survey, part-time self-employed photographers experienced a more significant shift in their specialties. Landscape lost its second-place spot to Family in 2024. Notably, Wildlife photography dropped entirely out of the top six specialties.

2024 Part-Time Self-Employed Specialties

2023 Part-Time Self-Employed Specialties

Age and Experience

The predominance of respondents aged 40 and older (77%) highlights the experience and longevity of older generations in the photography industry. This could indicate that photography is a career path where skills are refined over time, and older individuals play a significant role in the profession. The 60 and older demographic outpaced all respondents by accounting for 28% of responses.

have more than 10 years of experience.

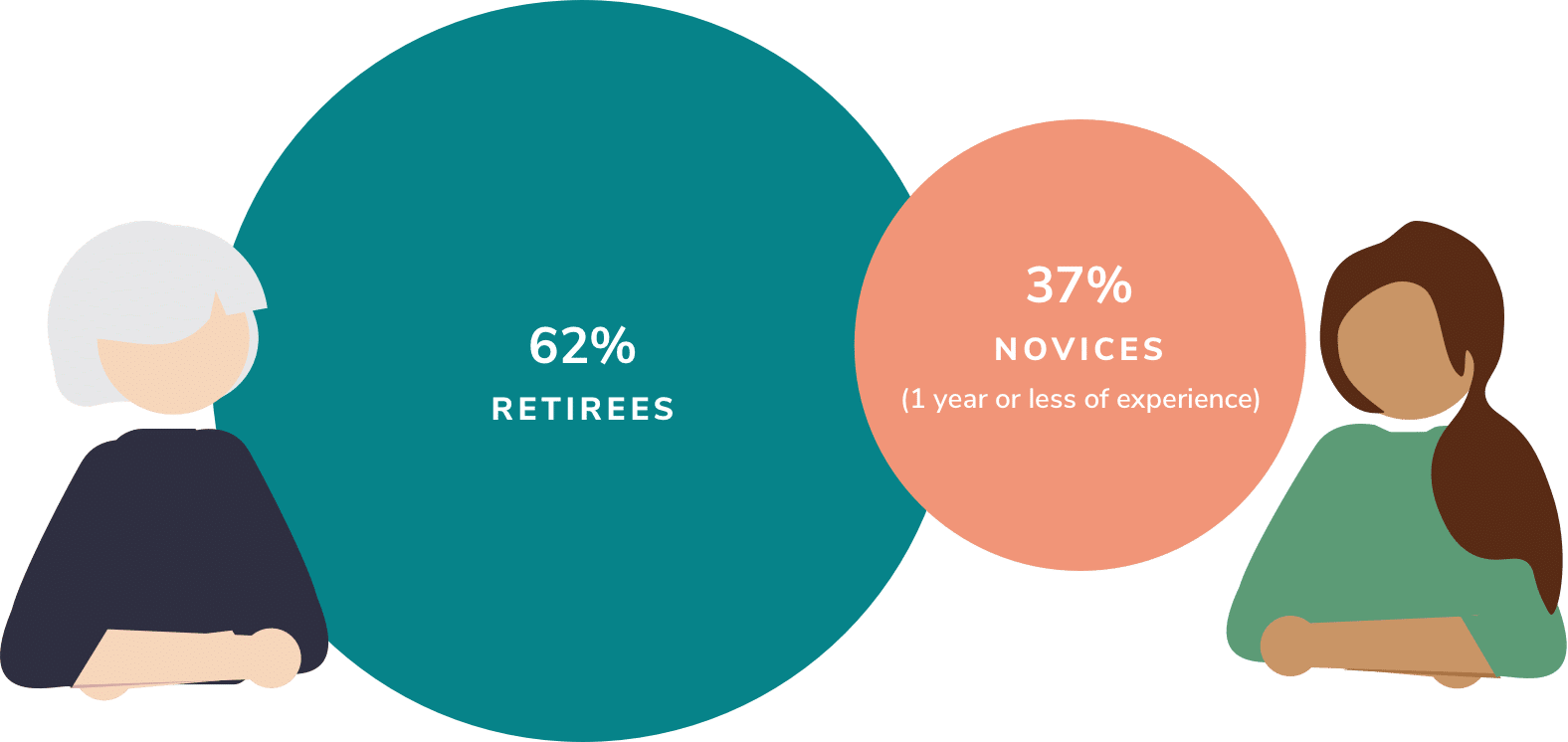

Retirees vs Novices

Among the photographers who responded to the survey, we noticed something interesting when we looked at two groups: retirees and novices (those with 1 year or less of experience). Turns out, there are more retirees than novices in this group—62% of them are retired, while 37% are novices. But when we look at all experience levels, Retirees only make up 4% of all responses, and novices with 1 year or less of experience are just 2.4%. This means that while retirees and novices are common within their groups, they're actually a small part of the whole survey.

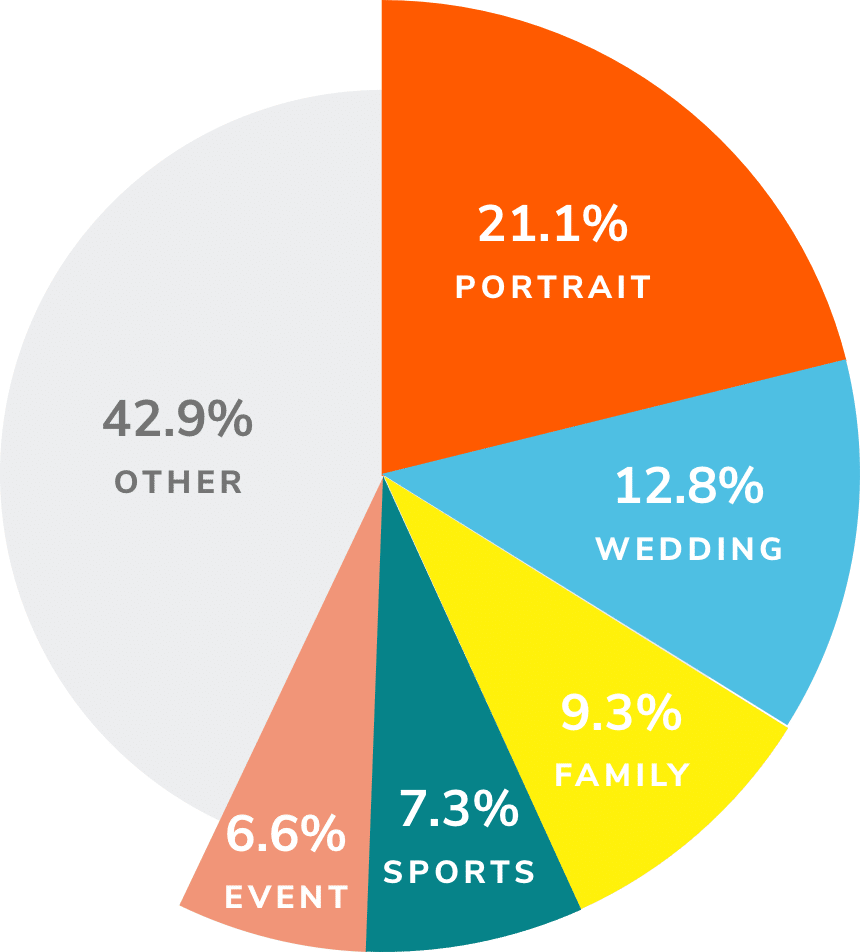

What’s your photography specialty?

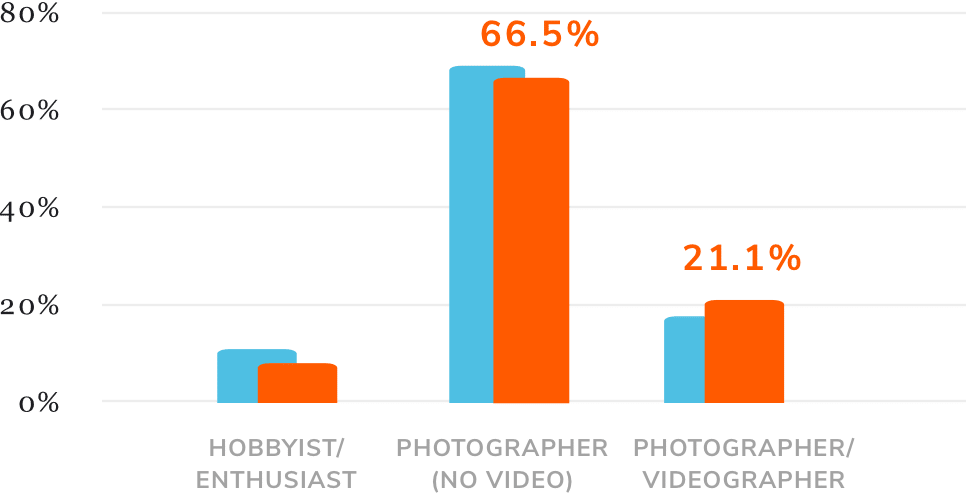

In the survey, participants were asked to specify their primary photography specialty.

This year, the top 5 specialties for photographers changed just slightly from last year. The top 5 this year included:

- Portrait

- Wedding

- Family

- Sports

- Event

Notably, Landscape photography has dropped from the top five, with all other types moving up one rank. Additionally, Event photography has entered the fifth spot. This shift may suggest a return to crowded and social events following the relaxation of social gathering restrictions imposed during the pandemic.

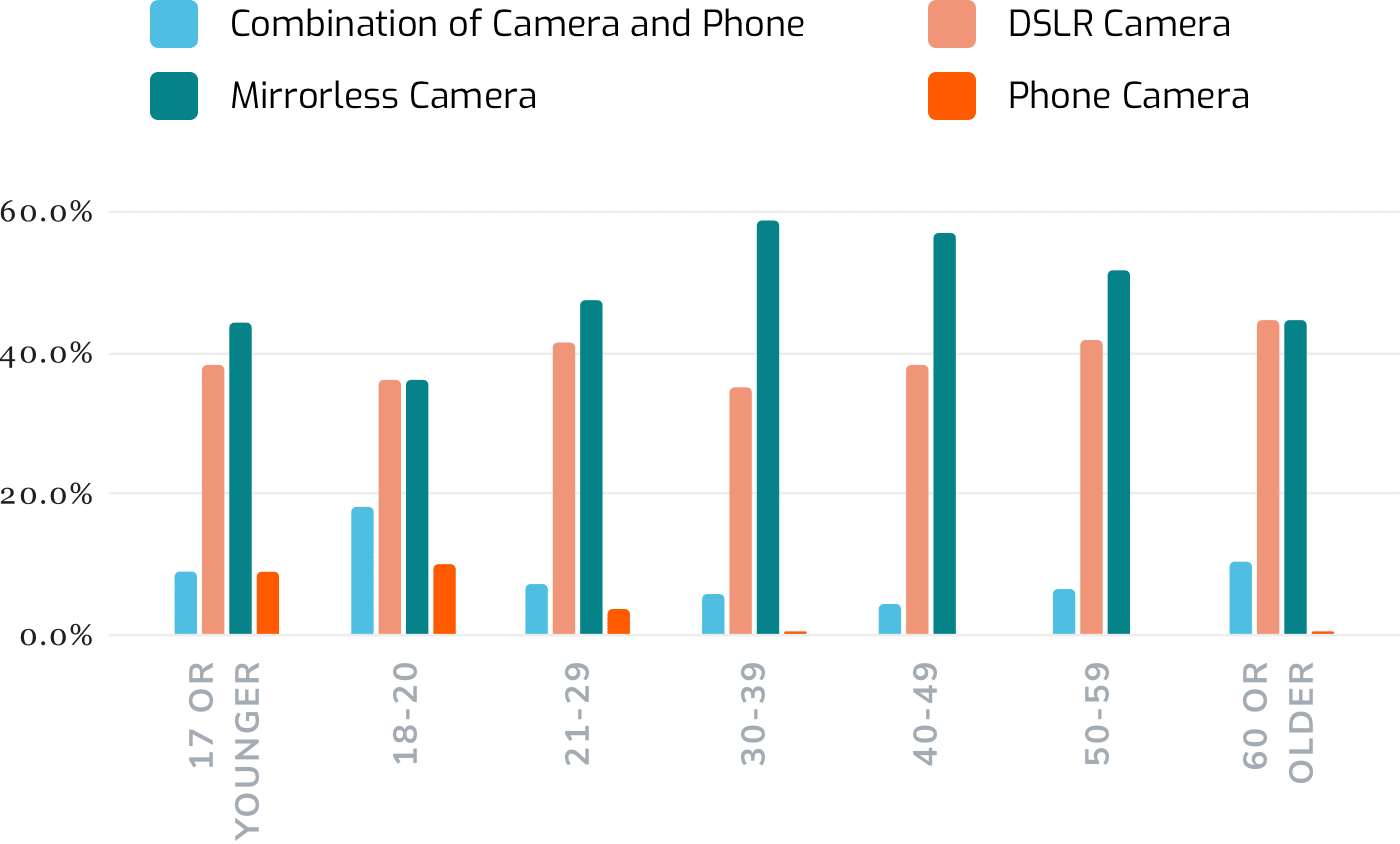

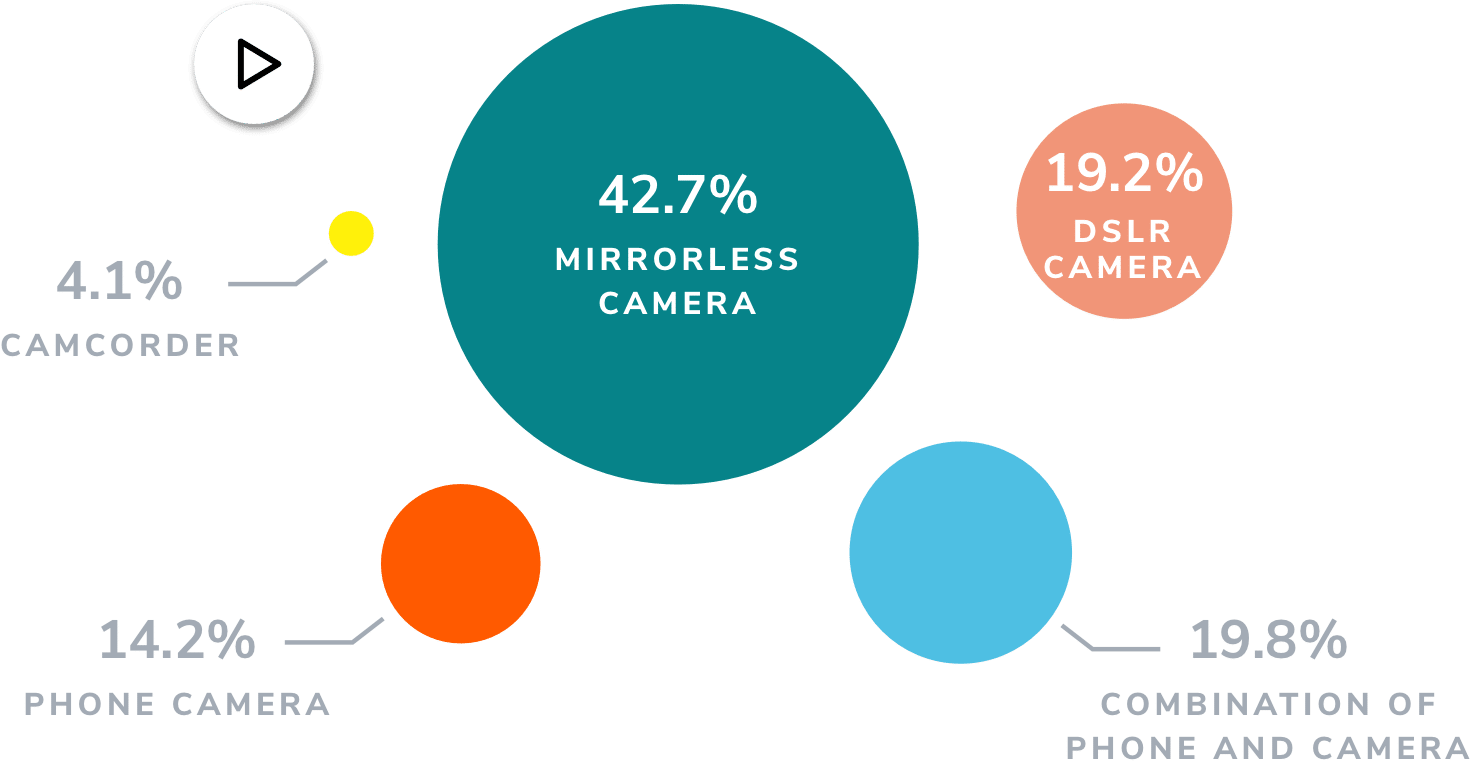

Go-to Gear

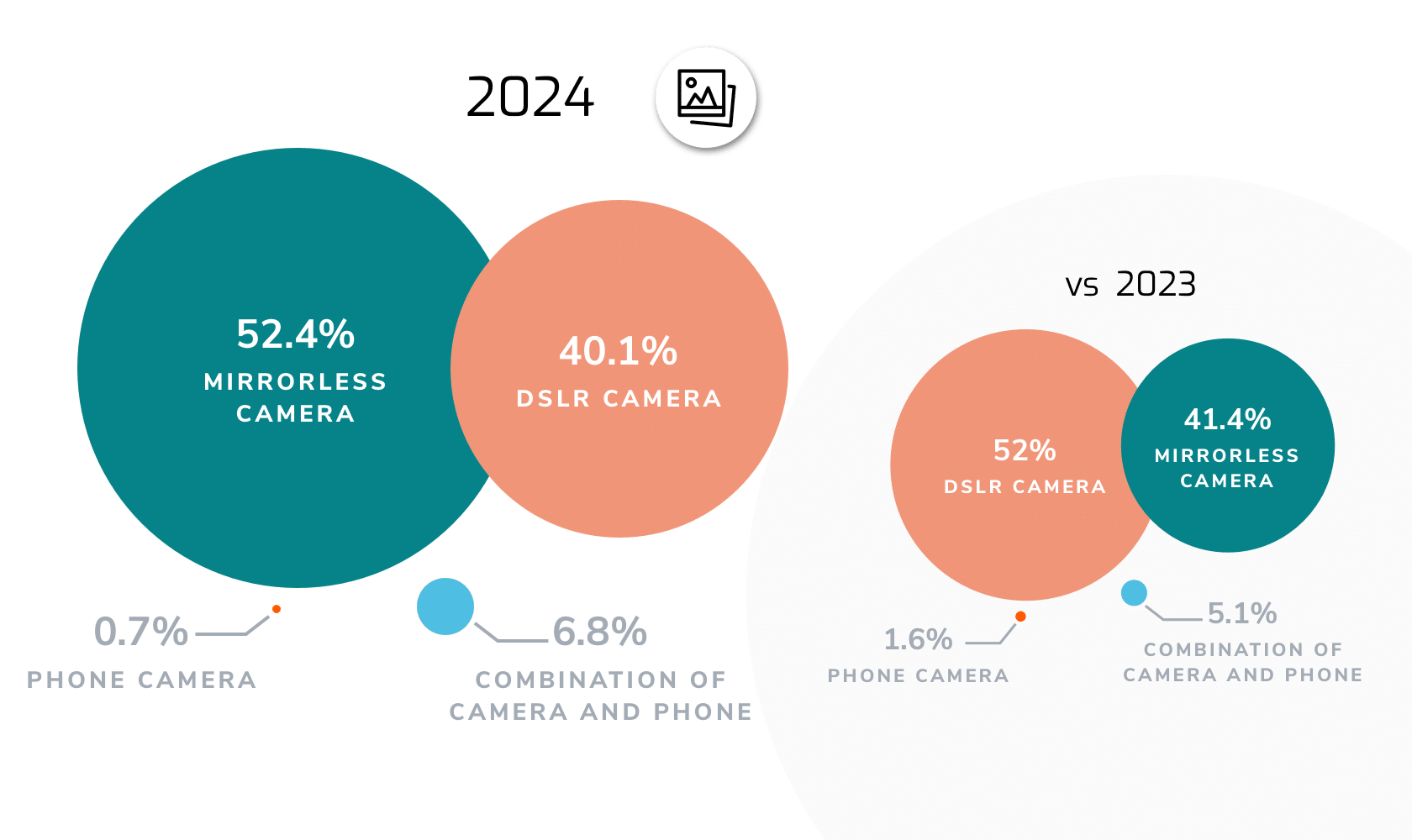

Last year, we wrote this line:

…while DSLRs are still the top choice for many professional photographers, the rise of mirrorless cameras … are posing a real challenge to their dominance.

In 2024, it seems this prediction has materialized, as photographers now slightly favor mirrorless cameras for capturing images.

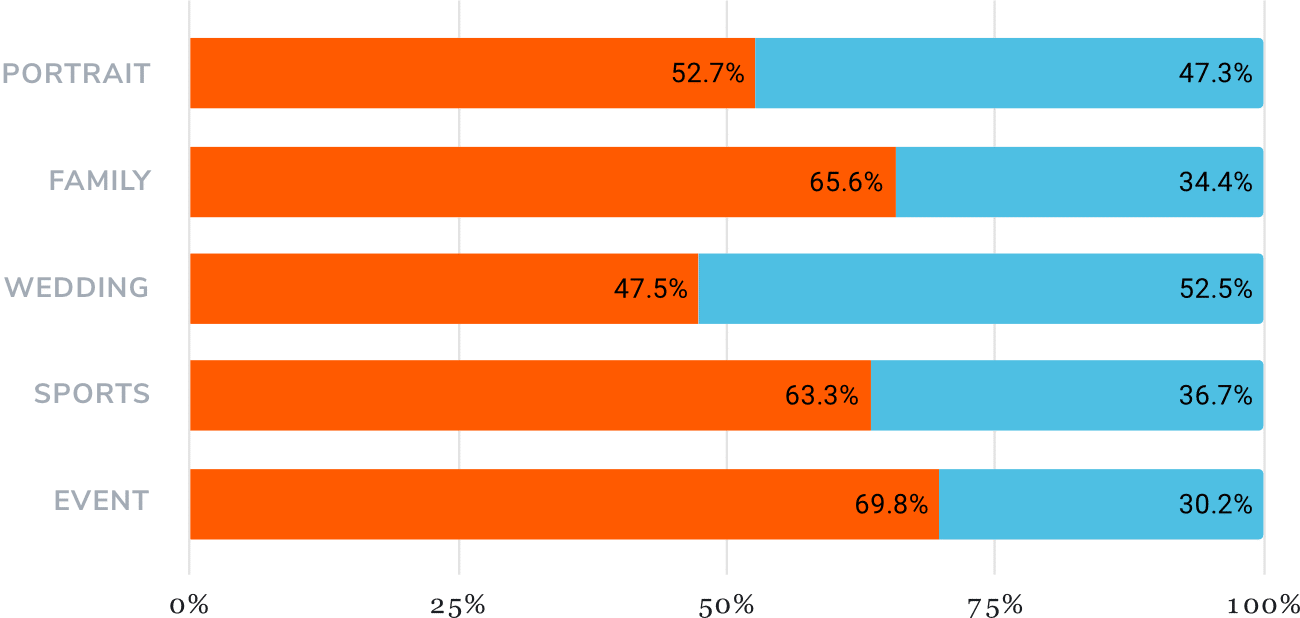

From the data, it's evident that Mirrorless and DSLR cameras are nearly equally favored by portrait photographers, collectively accounting for 49% of all responses in this category. Notably, Portrait, Wedding, Family, and Sports photography contribute to the top 50% of responses for both DSLR and Mirrorless cameras. However, Event photography shows a clear preference for DSLR cameras, as it does not appear in the top 50% for Mirrorless responses.

Additionally, the data reveals a consistent reliance on phone cameras, or a combination of phone and camera, for landscape photography more than any other specialty. This suggests a distinct preference within the landscape photography field for devices that are portable and versatile.

Mirrorless

DSLR

Phone

Camera & Phone

From the data, we can see that phone cameras are particularly popular among younger photographers in the survey, with the 18 to 20 age bracket showing the highest usage of phone cameras only (10%) or a combination of camera and phone (18%).

In contrast, the 30-39 age bracket demonstrates a strong preference for mirrorless cameras, with 58% of respondents favoring this type of camera.

Interestingly, the 60 and older age group shows an even split between DSLR (44.5%) and Mirrorless (44.5%). This data could suggest a gradual transition away from DSLR cameras towards Mirrorless cameras as they replace their primary camera body.

17 or Younger

18-20

21-29

30-39

40-49

50-59

60 or older

The 2024 survey reveals a clear preference for DSLR/Mirrorless cameras in video recording, with a significant increase of 5.5% from the previous year (56.4% in 2023 to 61.9% in 2024). The phone camera recording has experienced a slight decline, dropping from 16.9% in 2023 to 14.2% in 2024.

Interestingly, despite the prevalence of digital technology, a notable 4% of respondents continue to use camcorders for recording, highlighting a traditional approach among photographers. This highlights the enduring appeal and distinct advantages that traditional equipment holds for certain individuals within the photography community.

So…How’s Business?

Business seems to be looking up for photographers, as indicated by the survey results. Last year, 47% of photographers reported that their business was about the same or busier than expected. This year, that number has increased to 51%, suggesting a positive trend in business activity within the photography industry.

Moreover, the data reveals stability in the number of new business openings, remaining steady at 5.7%. Additionally, there has been a notable decrease in business closures, dropping to 0.95% from last year's 3%. These figures indicate a favorable business environment, with fewer photographers experiencing closures compared to the previous year.

As global economies grapple with inflationary pressures, nearly a quarter of surveyed photographers reported a significant increase in costs ranging from 6% to 10%. Conversely, the proportion of respondents who reported a decrease in costs dropped from 2.1% last year to 1.2% this year.

vs 2023

Among the specialties surveyed, Astro, Automotive, and Still Life photography reported the most substantial cost increases, exceeding 15%. In contrast, Macro, Equine, and Action photography reported reductions in operating expenses.

Notably, among the top five specialties, Family and Portrait photography recorded the largest percentage of respondents reporting cost reductions, with 1.48% and 1.47%, respectively. This data underscores the varied financial dynamics within different photography niches, with some specialties experiencing cost hikes while others manage to reduce their expenses.

A Deeper Dive into Revenue and Income

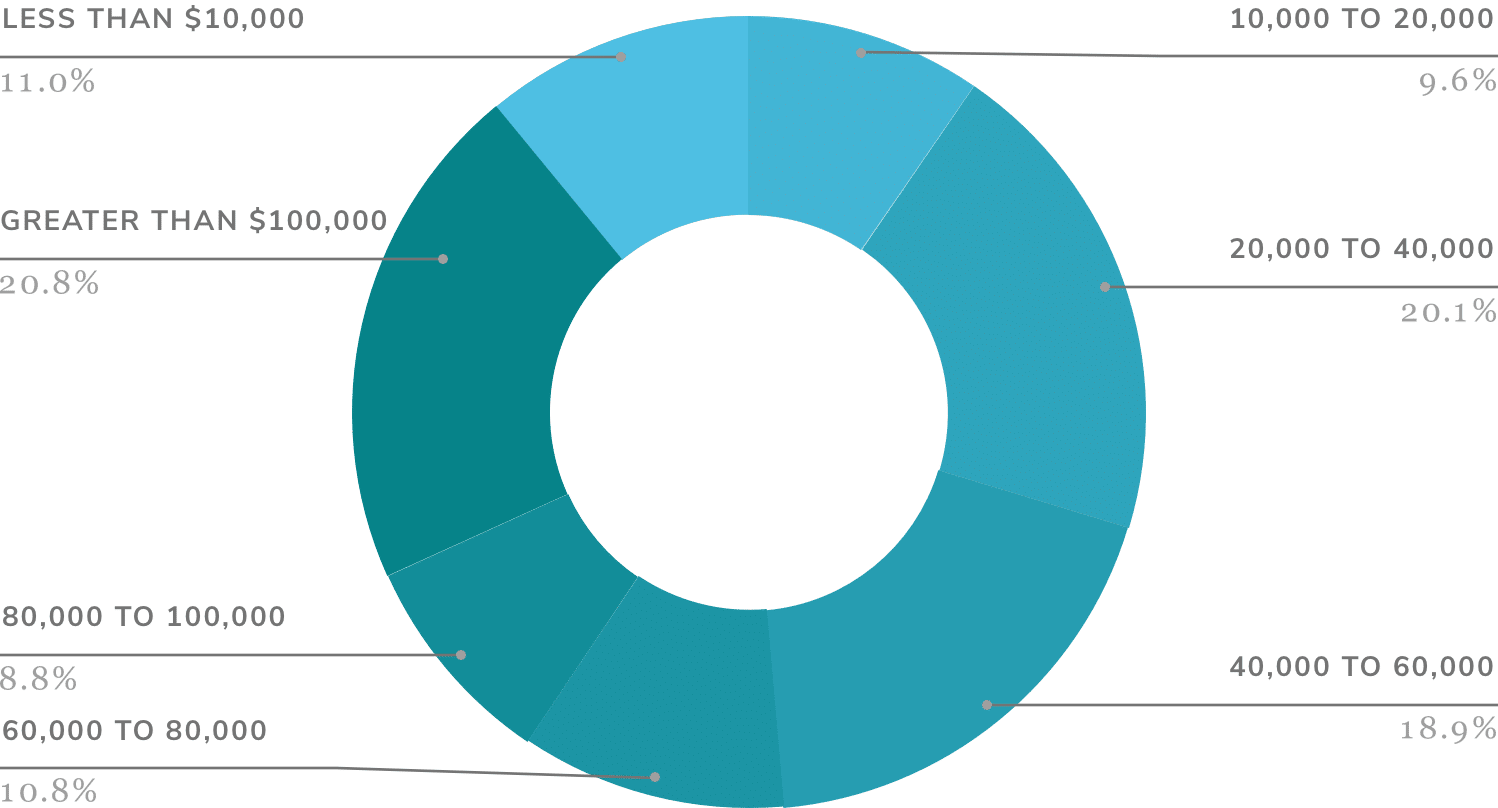

Full-Time Self-Employed

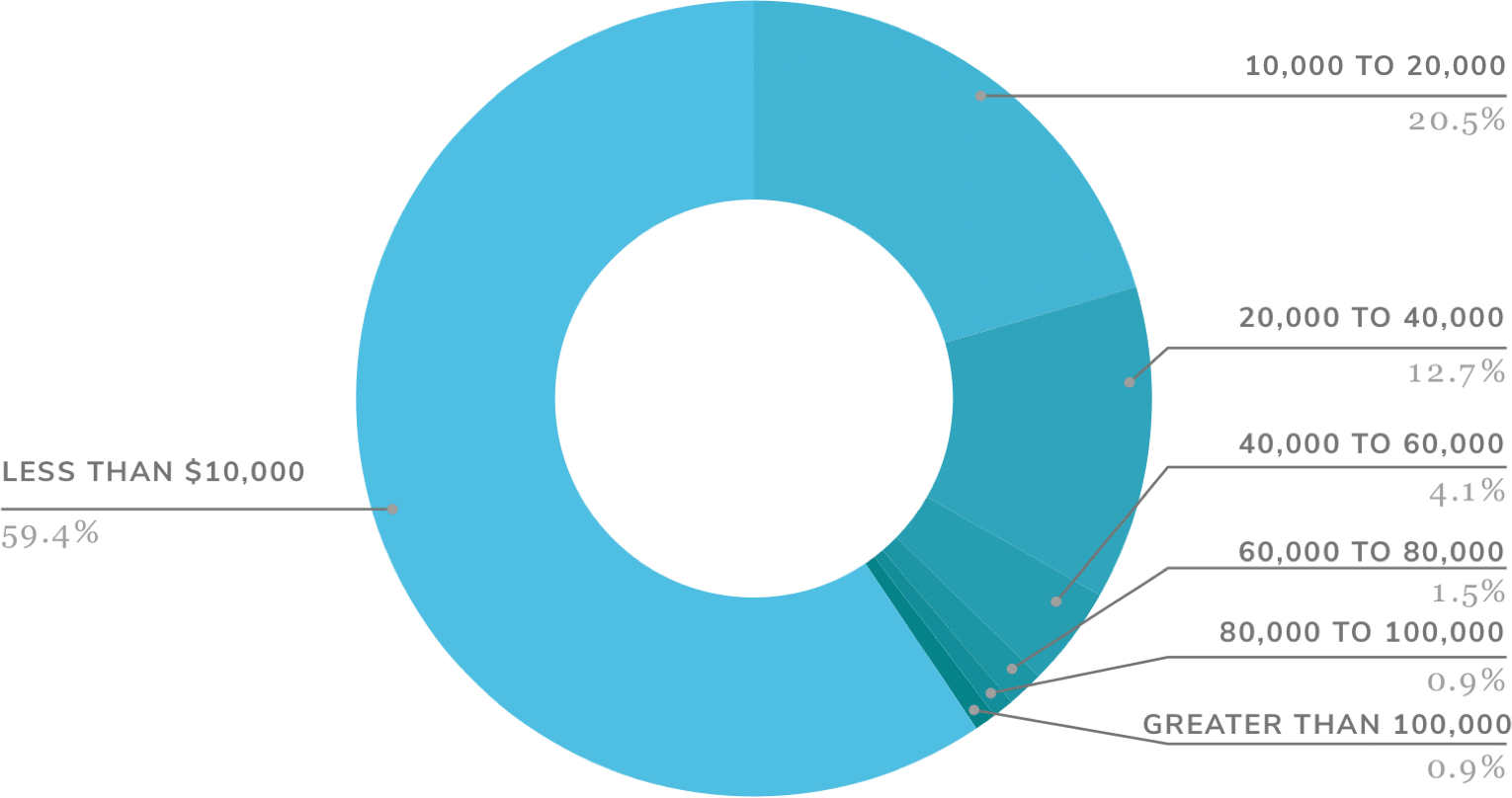

Part-Time Self-Employed

While full-time self-employed photographers experienced modest fluctuations across various income brackets, the most notable change was a 3.7% increase in the proportion of individuals earning more than $100,000. This shift may partly be attributed to the survey receiving 237% more responses compared to the previous year, potentially reflecting a more comprehensive representation of high-earning individuals. Conversely, part-time self-employed photographers saw a slight uptick in the percentage reporting earnings of less than $10,000, suggesting potential financial challenges within this demographic.

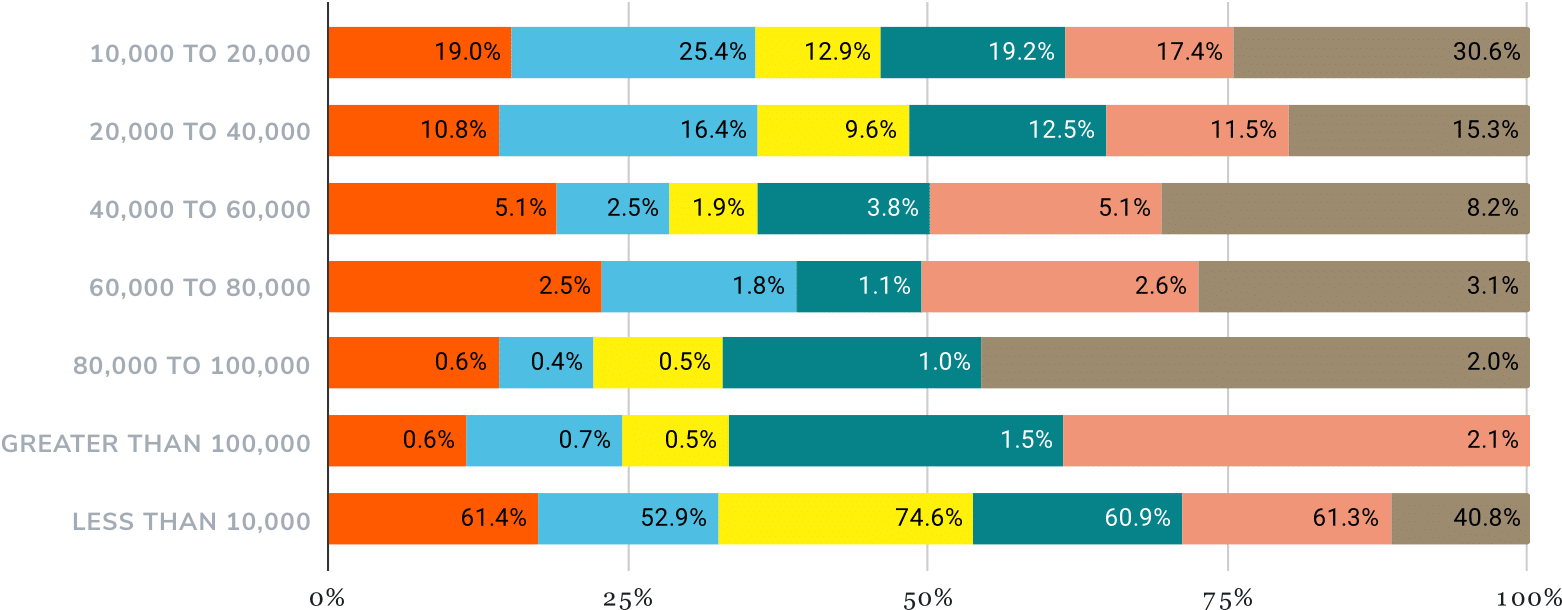

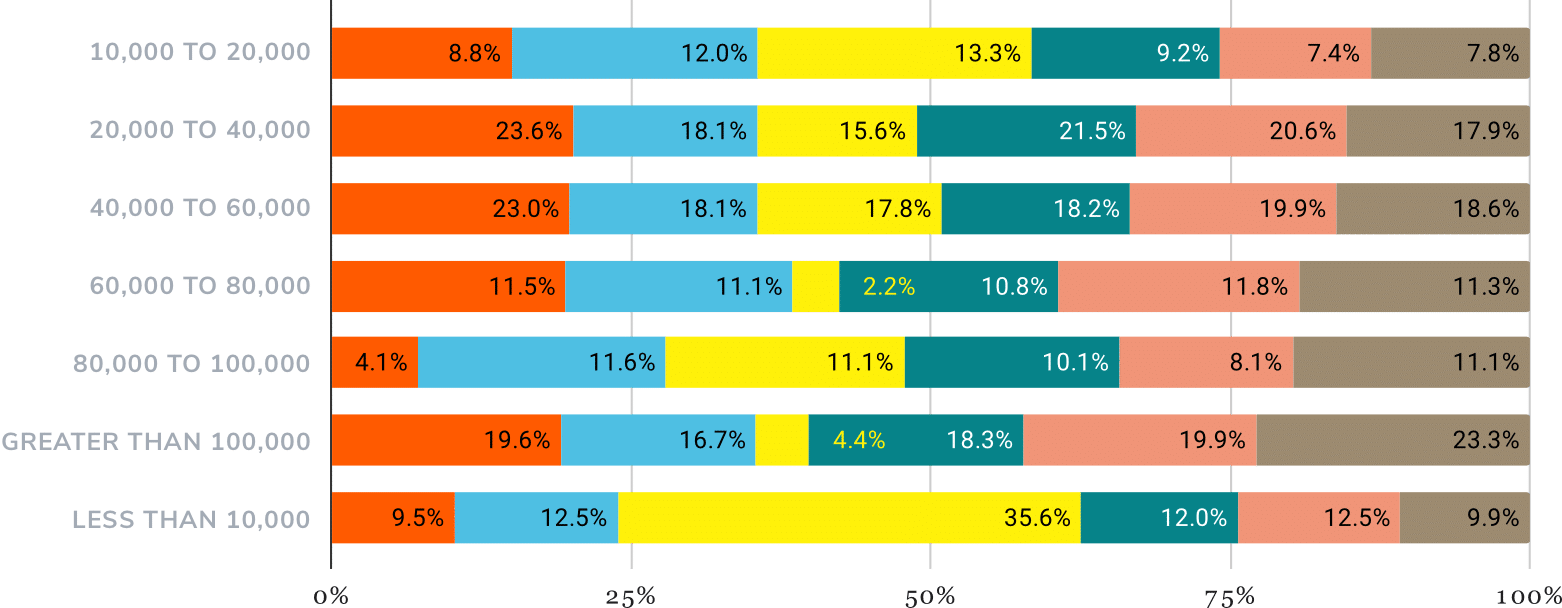

Making Bank

For part-time self-employed photographers, Wedding photography emerges as the most lucrative specialty among the top five in 2023, with just over 5% of respondents reporting earnings of $60,000 or more annually. Conversely, Landscape photography appears to be the least financially rewarding, with 74% of respondents indicating that their landscape specialty earns less than $10,000 annually.

In line with their part-time counterparts, full-time self-employed Wedding photographers stand out as top earners, with 23.3% of respondents reporting gross revenues exceeding $100,000 in 2023. In contrast, Landscape photography appears to yield the lowest income among full-time photographers, with 35.5% stating earnings of less than $10,000 in the same year.

Selling the Goods

From the data collected in 2023, it's evident that digital file sales dominated the photography market, with few exceptions. All specialty areas reported selling digital images, indicating their widespread popularity within the industry. However, in 10 specialties, print products were collectively more popular than digital offerings, with Street and Landscape photography leading in sales in this regard.

Moreover, among the print products sold in 2023, certain items surpassed digital sales in specific specialties. For instance, albums in Boudoir photography and unframed prints in Street, Landscape, and School photography demonstrated higher demand compared to digital images.

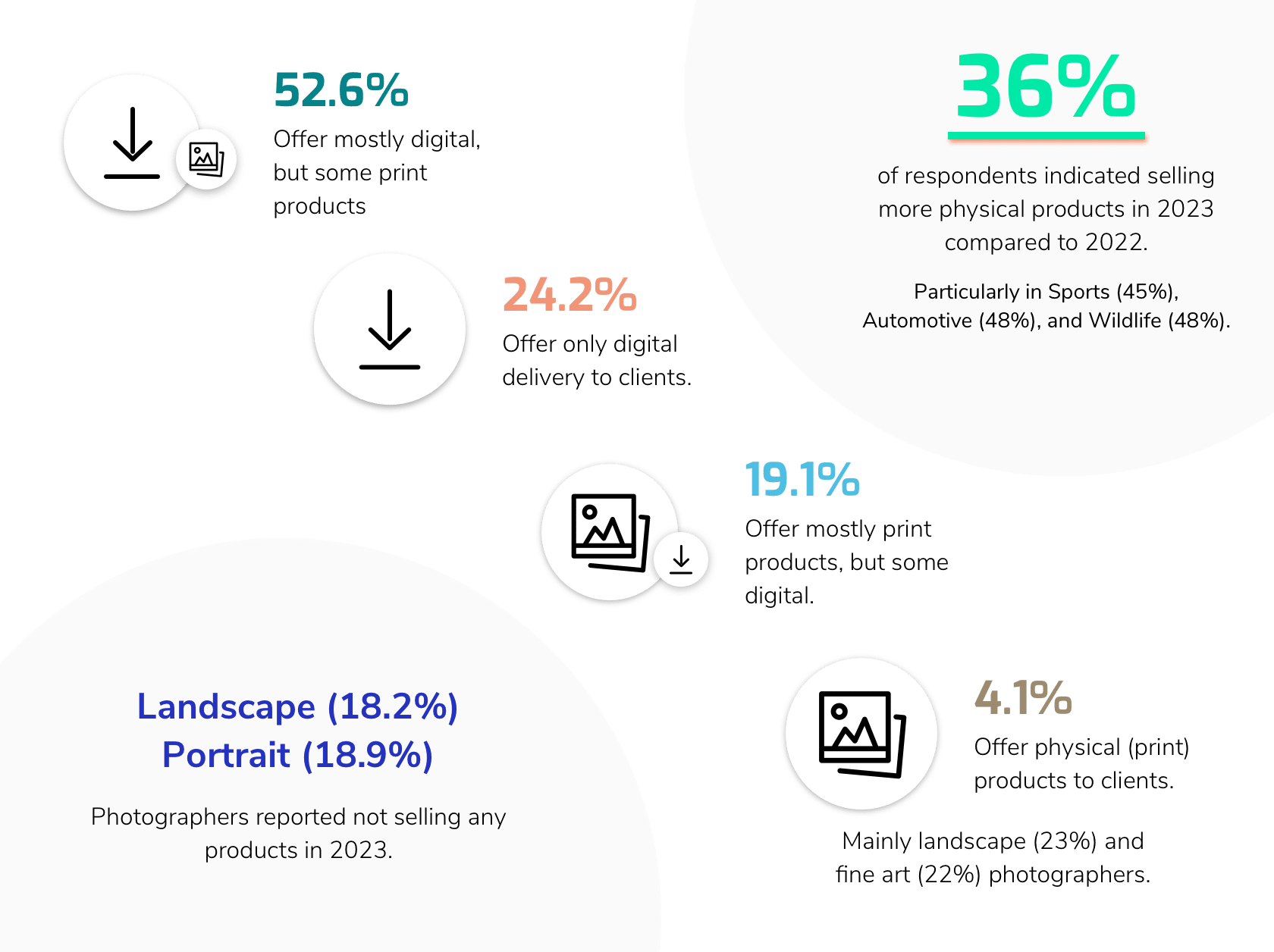

The survey also revealed that the majority of respondents (52%) offer a combination of mostly digital images and some print products, highlighting a preference for digital content supplemented by print options. On the other hand, only 24% of respondents exclusively offer digital images, indicating a smaller but still significant market for purely digital photography products.

By recognizing that different specialties may have unique preferences regarding product sales, photographers can enhance their sales potential, enabling them to customize their offerings to better suit the needs of their target audience.

When examining the specialties that exclusively offer physical print products, which accounted for only 4% of all responses, Landscape (23%) and Fine Art (22%) emerged as the top contributors to this category.

Interestingly, a significant proportion of Landscape (18.2%) and Portrait (18.9%) photographers reported not selling any products in 2023, whether digital or physical.

Furthermore, when comparing sales between 2022 and 2023, 36% of all respondents indicated that they sold more physical products in 2023 than in the previous year. This trend was particularly pronounced among Sports (45%), Automotive (48%), and Wildlife (48%) photographers, suggesting a notable increase in demand for physical products within these specialties.

A Look Ahead

As we look ahead to the remainder of 2024, there appears to be a slightly more pessimistic outlook among photographers compared to this time last year. While 71% of photographers expect their business to remain steady or become busier, this figure has decreased from 75% at the same time last year when looking into 2023. This sentiment is reinforced by 12.4% of photographers expecting their business to slow down for the rest of the year, compared to 7.2% at this time last year. These trends suggest a cautious approach among photographers amid potential economic uncertainties or market shifts.

vs 2023

Priorities and Concerns

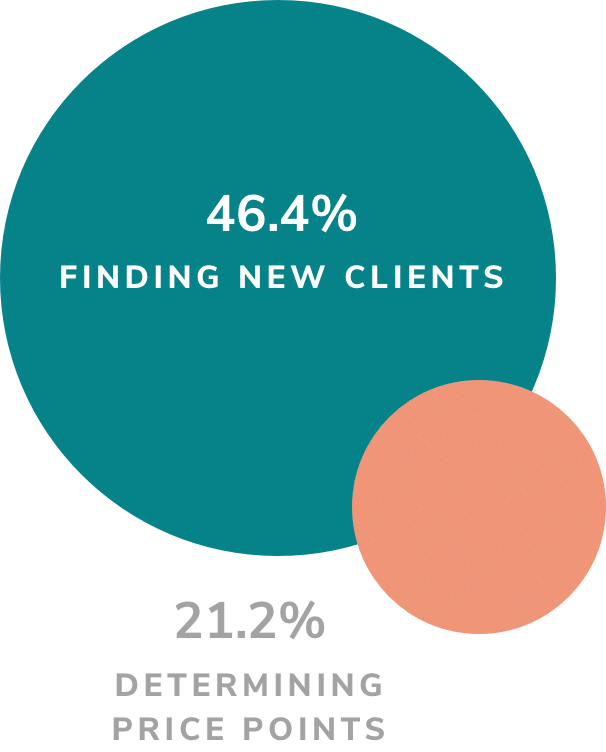

In 2023, client-based photographers' (photographers whose primary source of income comes from providing services to individual clients) primary concerns revolved around finding new clients, with 46.4% identifying this as their biggest challenge, followed by determining price points at 21.2%.

In contrast, non-client-based photographers (landscape/fine art) were mostly focused on selling products, with 31.8% indicating this as their main concern, closely followed by finding new clients at 23.6%. These findings highlight the different priorities and challenges faced by photographers depending on their business model and client base.

Client

Non-Client

AI and You

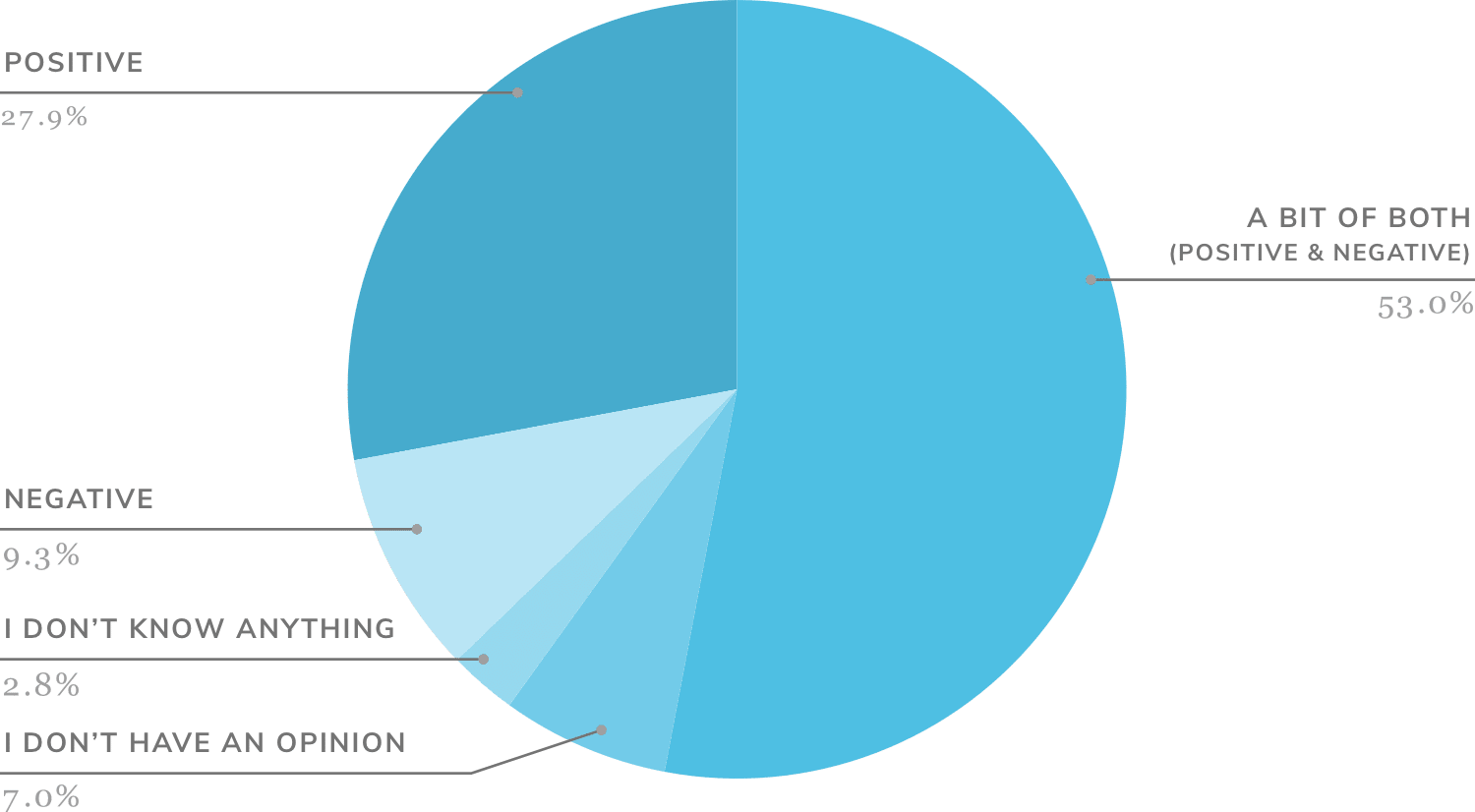

Last year, Artificial Intelligence, or AI, was a topic that was just entering the cultural zeitgeist. With many complex AI tools at our fingertips and more people being exposed to what's possible, it appears that AI is starting to be seen in a more favorable light.

The positive perspective on AI has grown 7% from last year. Opinions that included “Negative”, “I don't have an opinion”, and “I don't know anything about AI” have all dropped from last year by 2%, 8%, and 11% respectively.

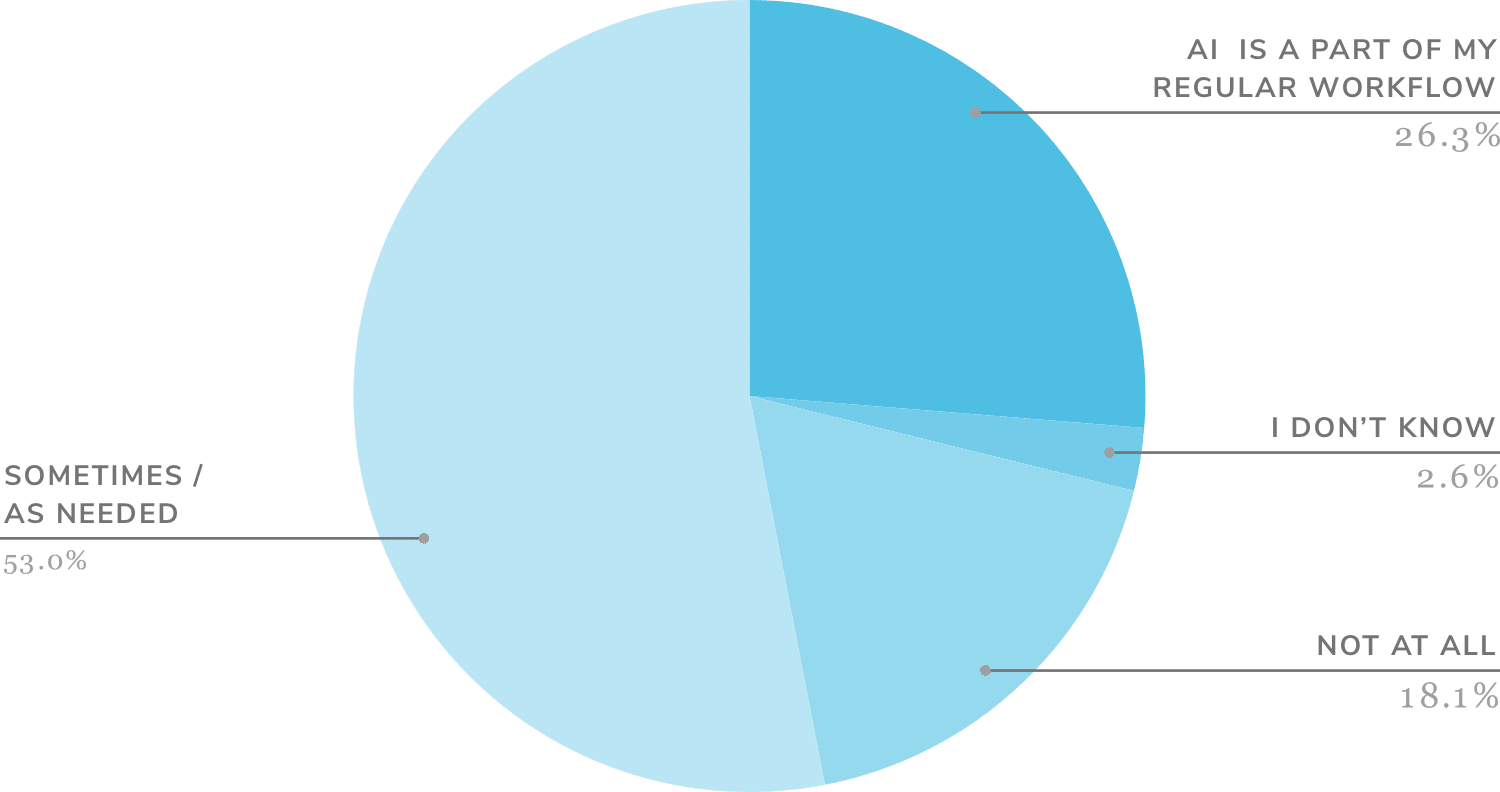

Additionally, AI usage among photographers has surged over the past year, fueled by the growing accessibility of AI tools.

Compared to last year, there has been a significant increase in the adoption of AI among photographers, with 12% more now using AI sometimes or as needed. Conversely, the percentage of photographers who haven't used AI at all has decreased from 46% to 18%.

Interestingly enough, many photographers may be utilizing AI tools without even realizing it. The most common applications of AI include noise reduction and background removal.

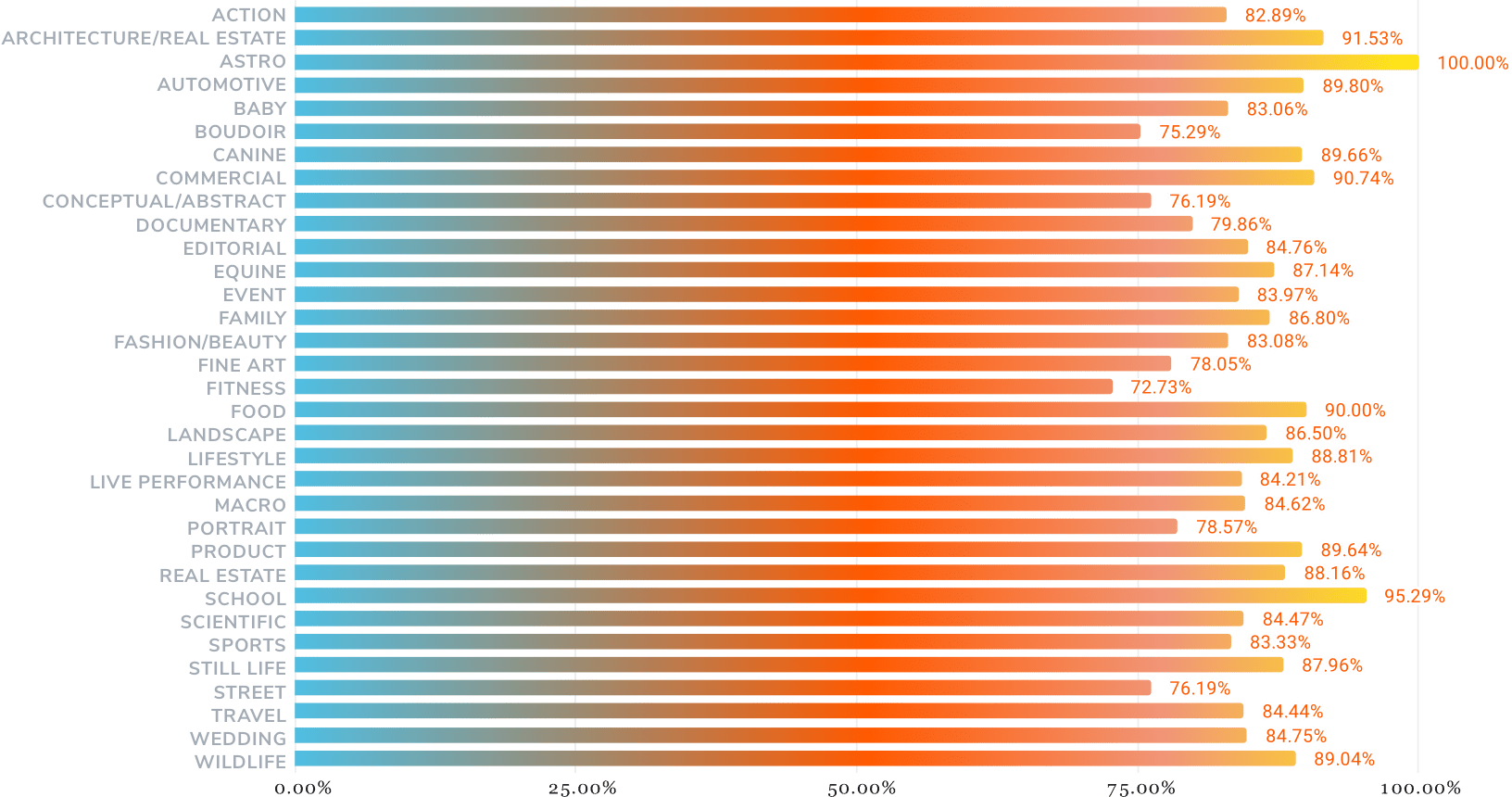

Finally, we observe the widespread adoption of AI across various photography specialties. While only two specialties surpassed 50% usage of AI last year, in 2024, we find that no specialty falls below 50% usage of AI.

Overall, the proliferation of AI across specialties signifies a fundamental transformation in the way photographers approach their craft, leveraging AI capabilities to enhance efficiency, creativity, and the overall quality of their work. As AI continues to evolve and become more accessible, its role in photography is likely to further expand, shaping the future of the industry.

Will We See You There?

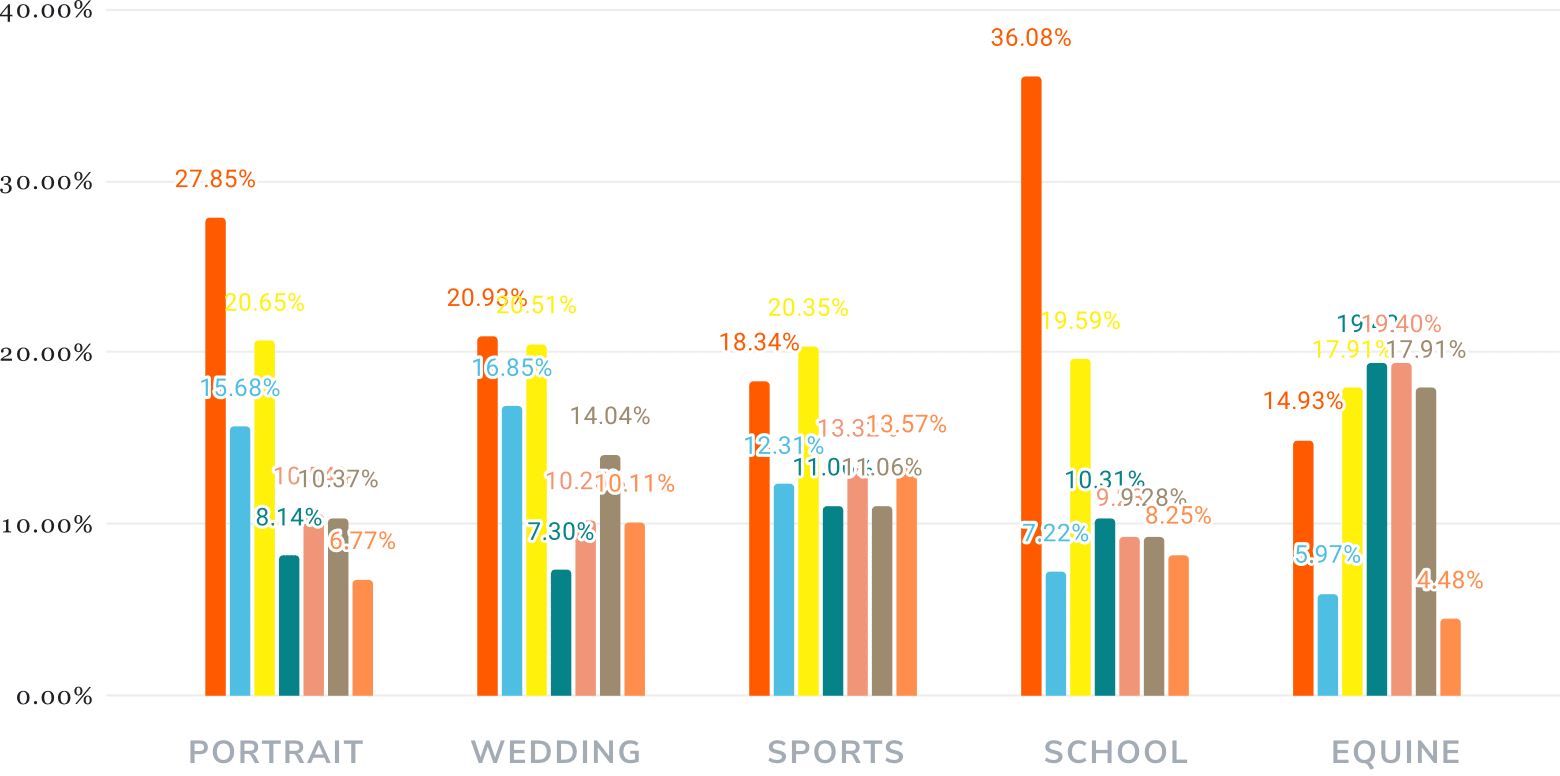

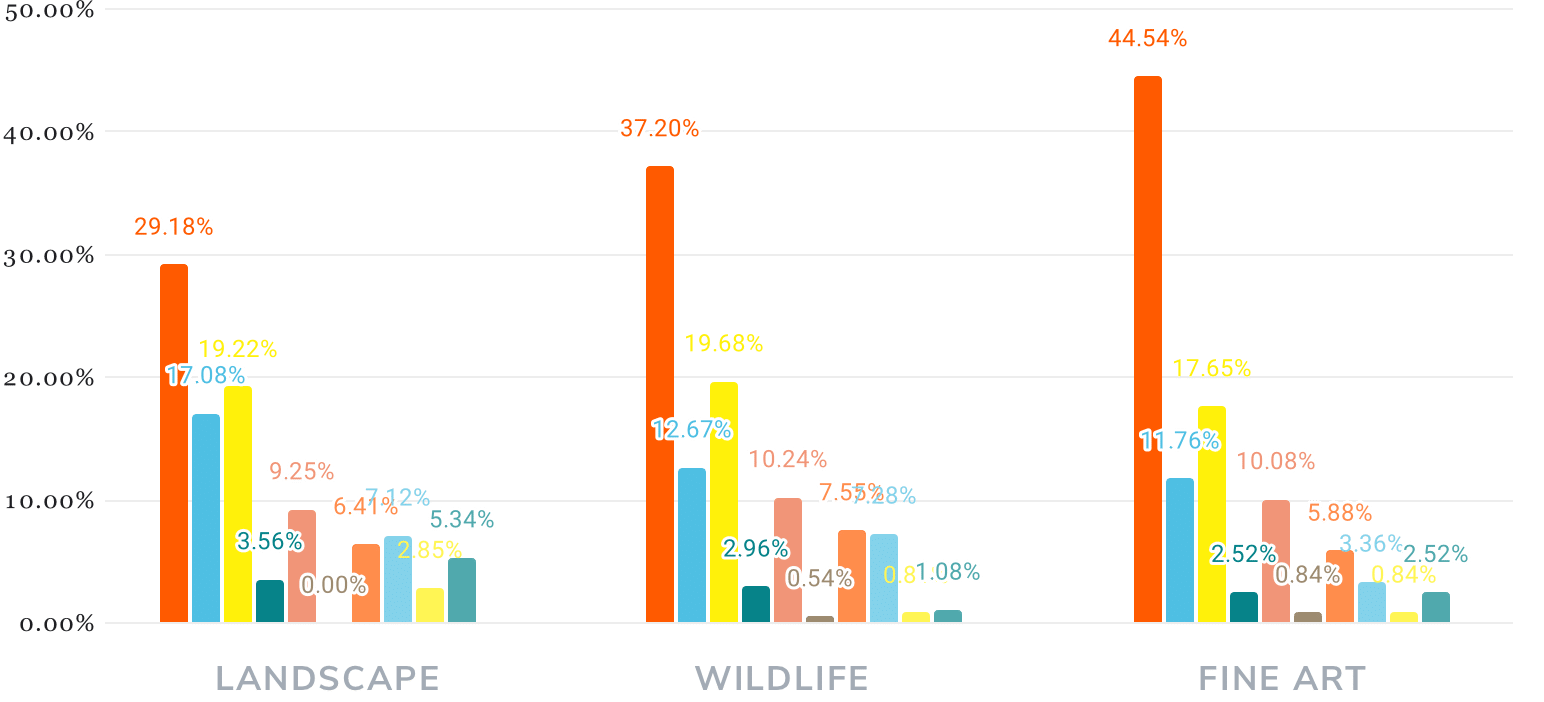

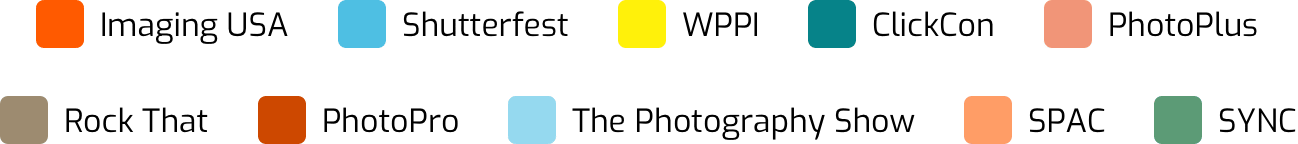

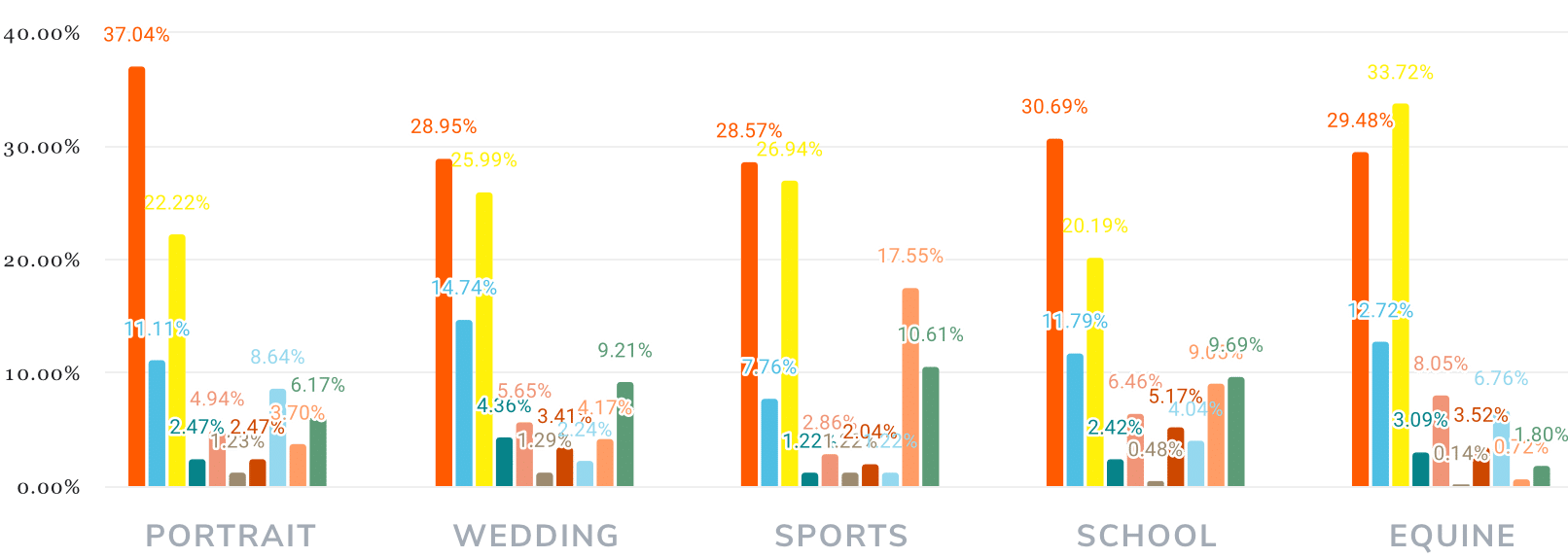

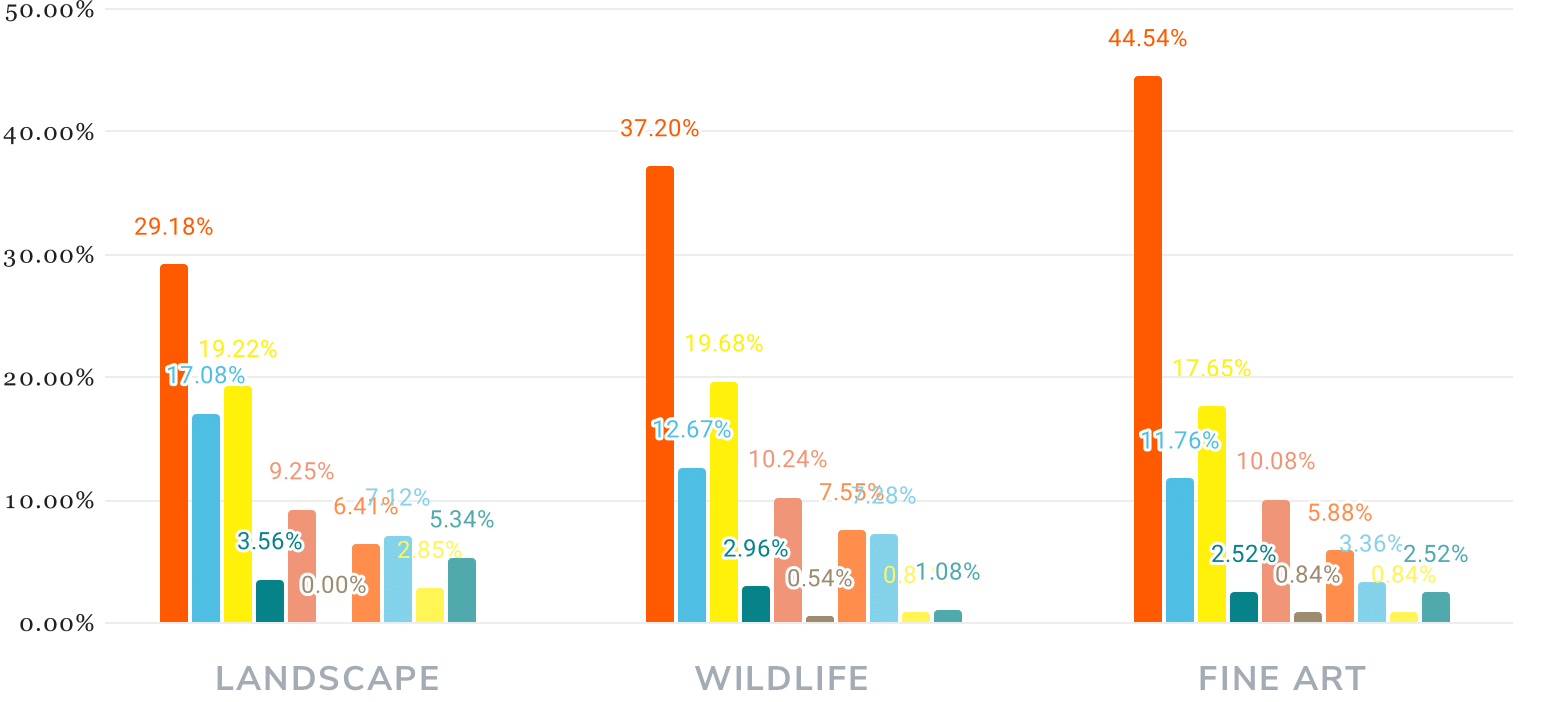

The single best way for photographers to see what’s happening in their field is by networking, and one of the best places to network is professional trade shows. This year, we inquired about the likelihood of attending a trade show.

You’ll most likely catch School photographers making connections, followed by their portrait peers.

For our non-client photographers, Fine Art photographers are most likely to schmooze at their professional trade events.

In a given year, nearly a dozen professional photography shows are occurring across the country.

We see all but Wedding photographers gravitate towards Imaging USA.

Imaging USA also reigns for the non-client photographer.

Conclusion

The findings from this survey provide valuable insights into the current state of the photography industry and its evolving landscape. In 2024, photographers are navigating a dynamic environment shaped by technological advancements, economic shifts, and changing client preferences. Notably, the survey reveals a widespread adoption of digital technologies, particularly evident in the dominance of digital file sales and the increasing use of AI tools across various specialties. This indicates that photographers are increasingly realizing the importance of adapting to emerging trends and utilizing innovative tools to remain competitive in the digital age. Furthermore, the data underscores the diverse challenges and priorities faced by photographers, from client acquisition and pricing strategies to product sales and the integration of AI technologies. As photographers continue to navigate these complexities, there is a clear emphasis on flexibility, creativity, and adaptability, with an increasing reliance on digital platforms and AI-driven solutions to meet the evolving needs of clients and stay ahead in an ever-changing industry landscape.